EoS Fitness, Crunch and Chuze saw the highest YoY visit growth in April while Life Time members spent the most time in club per visit, according to a new report

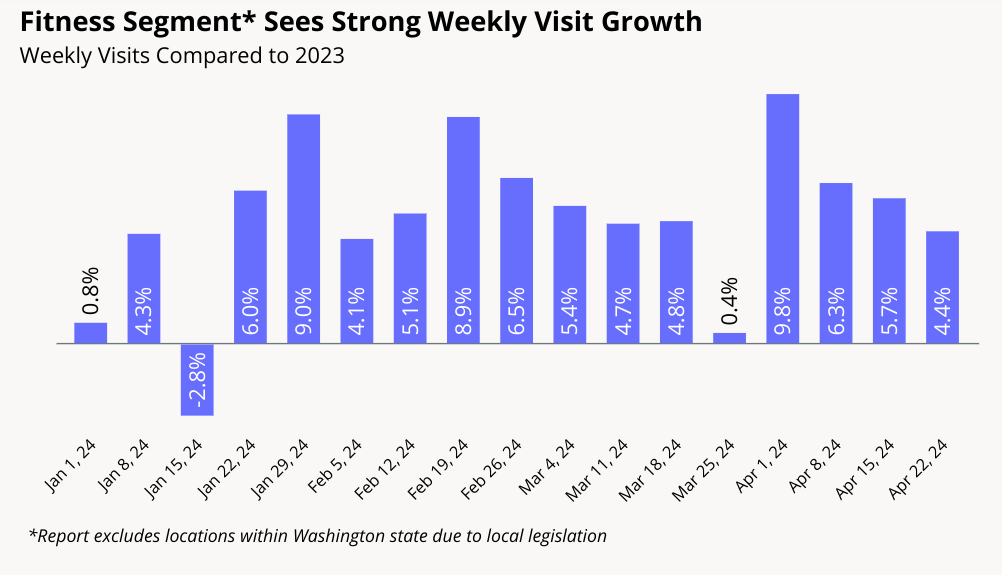

Major big-box gyms and health clubs including Planet Fitness, Life Time and Crunch Fitness experienced increased year-over-year visitation numbers nearly every week from January 2024 to April 2024, according to a new report.

Behind the encouraging findings for the fitness industry is Placer.ai, a software company that leverages location intelligence and foot traffic insights. Along with Planet Fitness, Life Time and Crunch Fitness, Placer.ai studied Chuze Fitness, EōS, LA Fitness, Anytime Fitness and 24 Hour Fitness.

April was an especially hot month for fitness clubs, with Placer.ai finding that visits nationwide were up 4.4% year-over-year during the week of April 22, 5.7% during the week of April 15 and 6.3% during the week of April 8. All brands featured in the report experienced year-over-year visit growth in April.

Overall, the findings should encourage operators like Planet Fitness for the long term. This week, the fitness franchise reported adding nearly one million new members in the first quarter of 2024 — impressive but less than the ‘Judgement Free’ gym anticipated amid elevated cancellations likely driven in part by a transgender bathroom policy controversy.

It should be noted that the new Placer.ai report follows – and seemingly contradicts – a more pessimistic study the software company issued earlier this year which found that foot traffic to ten major fitness operators in January 2024 didn’t increase from January 2023.

Here is a breakdown of each fitness brand and its visit performance when compared to April 2023, according to Placer.ai:

- EōS Fitness: +29.7%

- Crunch Fitness: +25.9%

- Chuze Fitness: +23.7%

- 24 Hour Fitness: +12.9%

- Planet Fitness: +10.5%

- Life Time: +9.2%

- LA Fitness: +6.1%

- Anytime Fitness: +2.5%

EōS, Crunch in Growth Mode

Topping the list was EōS Fitness, a high-value, low-price (HVLP) gym that hit the one-million-member milestone last year and announced its intentions to open 250 gyms by 2030.

Following EōS is Crunch Fitness, which has 460-plus locations and has plans to increase its growth rate by 20-25% this year, according to CEO Jim Rowley. CR Fitness Holdings, the largest operator of Crunch Fitness franchise locations with 60 gyms, just announced a partnership with Dallas Cowboys quarterback Dak Prescott to grow the brand even more.

Lingering at Life Time

There was also a strong association between visit frequency and duration, as brands with frequent gym-goers saw higher engagement in the form of more extended visits.

It’s a category that luxury brand Life Time is leading, with 43.3% of visits lasting more than 90 minutes. The athletic country club operator has invested heavily in delivering a top-notch experience for its members, who may linger at Life Time for pickleball, spas, personal training, small group classes and pools.

Low & High-Priced Facilities See Success

On the pricing front, Placer.ai inferred an appetite among fitness consumers for various pricing options, finding that visits to premium operators like Life Time and lower-priced clubs such as Planet Fitness climbed or remained stable over the study period.

Planet Fitness, which has maintained a $10/month base membership for nearly 30 years, is finally raising its price to $15/month beginning this summer for new members.

For its part, Life Time’s average monthly dues are now $186, up 12.7% from Q1 2023. Despite the high price tag and an inflationary environment, Life Time has seen memberships increase by 5% year-over-year from 2023 and has waitlists at many of its high-end facilities.

View the full Placer.ai report cited in this article here.