Earnings Call Takeaways: Nautilus Plans to Layoff 15% of Staff, Misses Q4 2023 Expectations

The Washington–based fitness equipment manufacturer is reducing its workforce by roughly 15%

Nautilus, a household name in fitness equipment, reported its third-quarter 2023 operating results and announced a 15% reduction in staff as a cost-saving measure.

On an earnings call this week, the Washington-based manufacturer of brands such as Bowflex, Modern Movement, Octane Fitness, Schwinn Fitness, and Universal Gym Equipment discussed its results and plans moving forward.

Times have been challenging for Nautilus, which has been hard at work with its ‘North Star strategy,’ a long-term plan that the fitness maker implemented to double sales by 2026.

To recap, at the close of 2022, Nautilus shared that it was better positioned to navigate short-term macroeconomic challenges after amending its credit facility via a refinance of its previous term loan with a new one.

The fitness maker had also discussed a potential sale last fall, with its Board of Directors hiring Evercore as a financial advisor.

Despite its recent efforts, Nautilus has missed its Q4 2023 expectations but is confident in its presence as a fitness hardware manufacturer. The fitness maker promises exciting new fitness products this year and says it has a firm grip on what fitness consumers want.

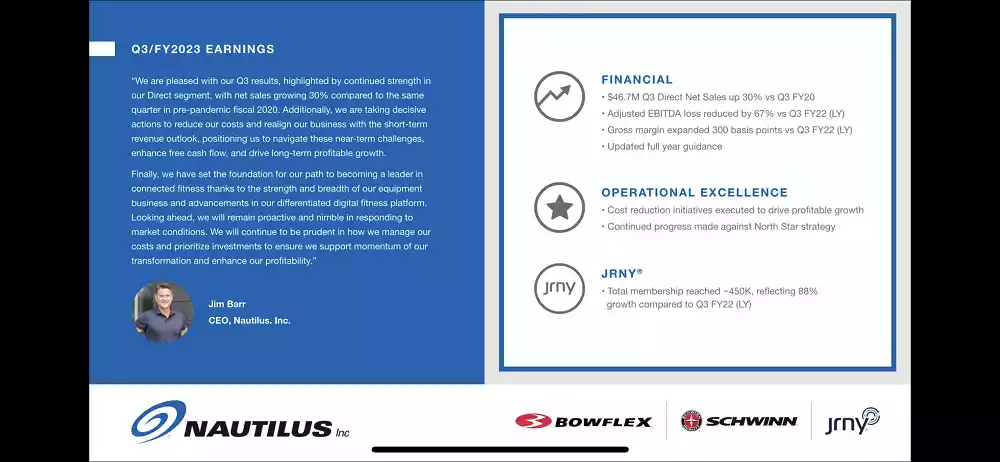

Here are some key highlights from the Nautilus third-quarter 2023 earnings call, which revealed the following results:

- Direct Segment Net Sales of $46.7M up 30% vs pre-pandemic Q3 Fiscal 2020

- JRNY Total Members Reaches Approximately 450k with 88% Growth vs Q3 Fiscal 2022

- Gross Margin Improves 300 Basis Points vs. Q3 Fiscal 2022 and 580 Basis Points vs Q2 Fiscal 2023

- Adjusted EBITDA Loss Reduced by 67% versus Q3 Fiscal 2022

- Executes $30M Cost Reduction Initiatives to Drive Profitable Growth

A digital offering win with JRNY growth

Nautilus reports continued momentum in its differentiated digital offering, sharing that it added over 50,00 JRNY members in Q3 2023, reaching roughly 450,000 JRNY members, an 88% increase compared to the same period last year.

The JRNY digital fitness platform and app underwent a major overhaul in 2021, which Nautilus executives stated at the time was only the beginning of the company’s vision for connected fitness.

Nautilus is continuing to enhance and scale its digital offering, and recently unveiled JRNY with motion tracking, allowing for personalized coaching, feedback, rep counting, and customized workout recommendations.

“We continue to target approximately 500,000 members by the end of the fiscal year, which implies approximately 54% year-over-year growth in fiscal 2023,” Nautilus CEO Jim Barr noted. “We are also seeing progress on conversion to paid subscribers, which are growing faster members.”

Retailers are currently hesitant & will continue to be conservative for a bit longer

While Nautilus reports ‘solid demand’ in its direct business and momentum with its connected fitness offering JRNY, the company is navigating persistent retail headwinds. According to Nautilus CEO Jim Barr, retail net sales declined 6% compared to Q3 fiscal 2020.

Barr noted that retailers continue to take a conservative approach in light of economic uncertainty, reporting that Nautilus is seeing lower levels of re-orders, impacting its sales outlook for its retail segment in the fourth quarter.

He added that Nautilus expects to see the same into the first half of fiscal 2024, adding, “If they’ve been conservative so far, they’ll probably continue to be somewhat conservative and we baked that into our outlook.”

The Nautilus CEO still believes in the retail channel as an important long-term component as the macro environment stabilizes, noting that it holds a ‘strong market share,’ especially after significantly increasing the number of retailers over the last couple of years.

Barr points out that the slowdown is simply a result of the economic environment, reminding investors that retailers haven’t dropped products or categories. “It’s just this conservative nature of reordering that’s been at play here,” he said.

Cost-saving measures & operational efficiencies

Barr reports that Nautilus has taken additional near-term steps to rightsize its business, emphasizing operational efficiencies. These include enhancements to the Nautilus supply chain, improvements to its inventory management, and optimization of its advertising.

“As challenges in the retail business persist, we have taken additional proactive steps to reduce our cost by an expected $30 million on an annualized basis,” Barr said.

One method that Nautilus has leveraged is the reduction of its contracted labor, as well as a 15% reduction of its staff.

“These actions, while difficult, are grounded in our priority to continue to align our cost structure with our revenue expectations and are aimed at driving profitability and improving cash flow,” Barr said of the planned Nautilus layoffs.

Nautilus executives also plan to strengthen its balance sheet and said it is continuing to improve its inventory position, with expectations that levels will decrease further in future quarters.

The North Star strategy continues with ambitions to be a connected fitness leader

Nautilus remains committed to its North Star strategy to address near-term challenges, and Barr believes the fitness maker has set the foundation to becoming a connected fitness leader.

“At our core, we excel at equipment, we continue to see demand for our fast moving top sellers and traction in our direct channel. Our focus remains on providing consumers with a broad variety of superior products at a range of price points,” he said.

Upcoming new fitness products

New fitness products are planned for the year, which Barr said is a strong lineup of updated connected fitness equipment. “It’s important to stress that we make money in the equipment business and this will be key to our path back to profitability,” he noted.

As far as what new products are on the horizon, Barr said they should be expected this year, but is remaining mum for now.

“We’re not prepared to announce what those are yet for competitive reasons, but we are very, very excited about that,” he said.

The new equipment offerings will have the company’s new ‘visual brand language,’ with Barr noting that Nautilus has really invested in transforming the Bowflex branding and identity, which he said will come across on the upcoming hardware.

“We’ve learned a lot in the pandemic about how people are using equipment, which rooms of the house it’s migrated to, how many pieces people are buying,” he said. “All of these things have changed profoundly and so you’ll see our lineup for calendar year 2023 reflecting all of those learnings.”

Barr understands Nautilus customers, revealing that connected fitness is its equipment portfolio, partnered with JRNY, which is what customers want. “That’s what our target wants. And we will continue to deliver both those things,” Barr said.

Nautilus researched home fitness & says it’s well-positioned to meet consumer needs

According to Nautilus, home fitness isn’t going anywhere, and it’s ready to meet those needs in the long run.

“We have conviction in the long-term opportunity of home fitness,” said Barr, adding that Nautilus research shows the shift to home fitness has remained steady for over two plus.

“Over 65% of U.S. adults recently surveyed continue to say they work out at home up from 43% who reported the same at the beginning of 2020. In our target segments, this trend is even more pronounced with about 85% working out at home,” Barr said.

“This is a prevailing shift in trends and Nautilus is well positioned to take advantage of this sustainable increase and demand in our long-term addressable markets,” he added.

Nautilus won’t abandon its equipment hardware for connected fitness

Even though Nautilus is excited for its connected fitness offerings and successes with JRNY, the fitness maker is confident in its hardware. Unlike other fitness companies who have pivoted towards digital offerings, Barr says Nautilus has no plans to drift away from its equipment offerings.

“We excel in the hardware business,” said Barr. “We know our path back to profitability centers around continuing to be good at creating great hardware and selling it.”

Courtney Rehfeldt has worked in the broadcasting media industry since 2007 and has freelanced since 2012. Her work has been featured in Age of Awareness, Times Beacon Record, The New York Times, and she has an upcoming piece in Slate. She studied yoga & meditation under Beryl Bender Birch at The Hard & The Soft Yoga Institute. She enjoys hiking, being outdoors, and is an avid reader. Courtney has a BA in Media & Communications studies.