Health & Fitness App Market Shows Promise Despite Decline in Downloads

The health and fitness app market generated $1.7 billion in revenue in 2022, an increase of $600 million from 2020

While there has been a sharp decline in health and fitness app downloads post-pandemic, retention rates and revenue have increased, providing strong reasons for optimism, according to a recently released report.

With a return to normalcy following the rise of at-home fitness during the pandemic, a new report by AdQuantum has revealed key findings regarding the health and fitness app industry during and after COVID.

Here are some highlights from “The State of the Health & Fitness App Market 2023,'” which examined download, usage and consumer spending trends from Q1 2020 through Q4 2022.

A Decline in Downloads but Resiliency in Terms of Revenue

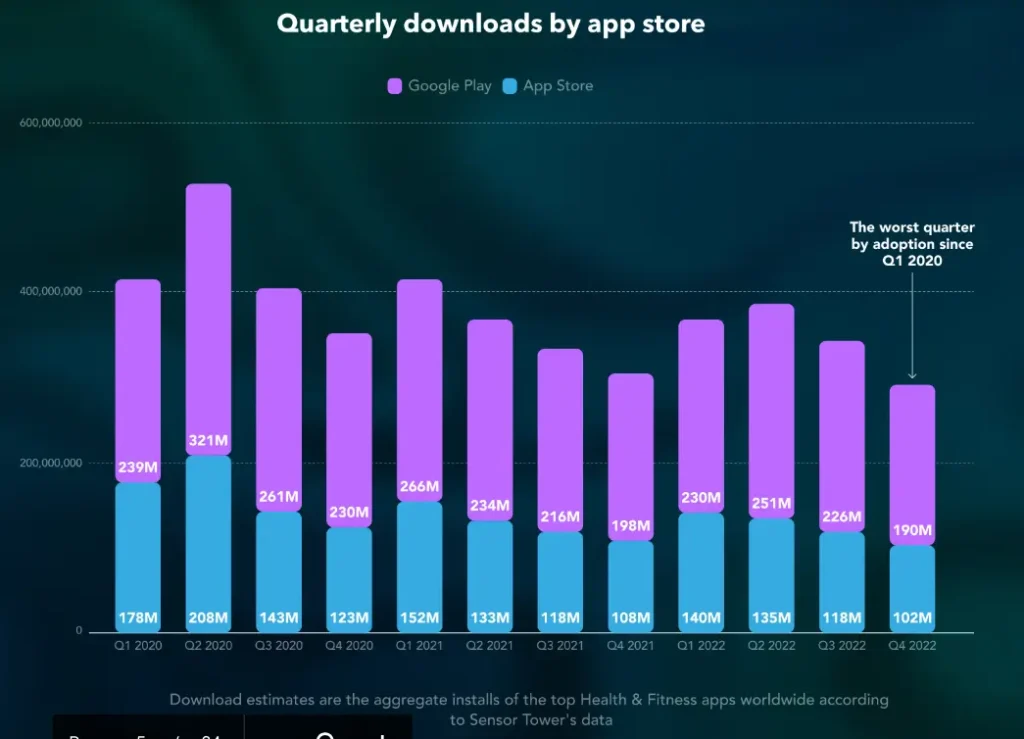

In Q4 of 2022, health and fitness app downloads surpassed 290 million across App Store and Google Play, which the report points out is the worst quarter since Q1 2020, with 417 million downloads.

However, while the pandemic led to unprecedented growth for the fitness app vertical, that momentum didn’t fizzle out as much as it did for at-home connected fitness companies like Tonal and Peloton.

The report reveals that the health and fitness app market generated $1.7 billion in revenue during 2022, an increase of $300 million from the previous year and $600 million from 2020.

During the pandemic lockdown, apps that provided customized workout routines, meditation, and diet and nutrition plans accelerated as far as downloads.

Since then, certain apps have remained popular, despite a return to normalcy. In 2022, there were 1.4 billion health and fitness app downloads, showing consumers are still willing to integrate an app into their wellness journey.

However, the number of app installs in 2022 slowly dwindled after 2020, which AdQuantum says can be attributed to the return of in-person activities.

It could also mean that while the pandemic may have meant fertile ground for the growing health and fitness app industry, it wasn’t necessarily an organic demand. Because consumers were stranded at home and their fitness facilities were closed, they were forced to rely on apps or at-home hardware. They also had extra cash on hand because gym memberships had been canceled or placed on pause.

Increased Consumer Retention & Stickiness

While app installations may have decreased, retention rates and stickiness increased.

For example, sessions increased by around 1% and are currently up another 1% this year compared to Q4 2022. The report demonstrates that consumers who downloaded apps during the “install boom” have been retained.

Retention rates in Q3 of 2021 were 25% for Day 1, with Q3 of 2022 at 35%. Additionally, Q4 2021 had a 21% retention rate, and by Q4 2022 that number had hit 38%.

As for the median stickiness for health and fitness apps, in Q3 and Q4 of 2021, rates were 15% and 14%, respectively, and have increased over time. Stickiness rose to 20% for Q3 2022 and 21% for Q4 2022.

Consumers Embrace Meditation & The Great Outdoors

The surge in health and fitness apps has led some companies to emerge as market leaders as consumers are increasingly concerned with their health and wellness.

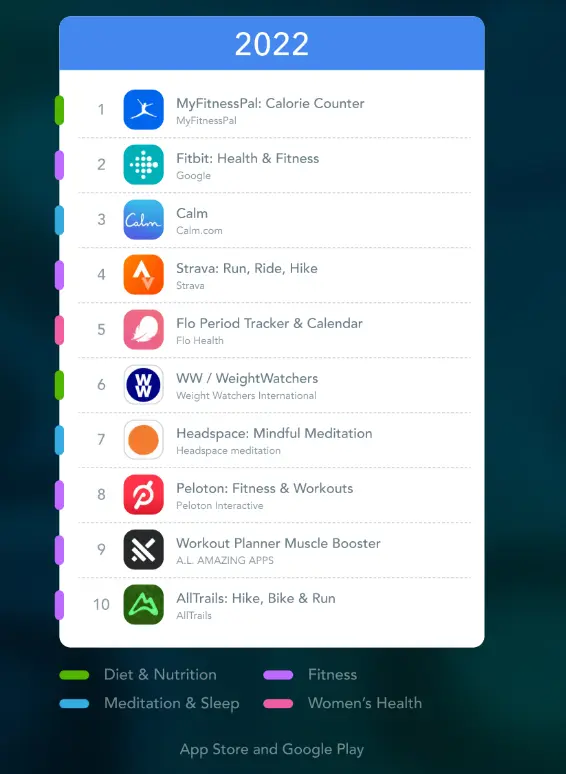

Taking in the #1 spot for highest revenue is MyFitnessPal: Calorie Counter, with Fitbit: Health & Fitness coming in second.

However, it’s the third ranking that may indicate where the wellness industry is headed.

The report reveals that meditation apps, such as Calm (#3 in revenue) and Headspace (#7), are gaining traction globally as consumers seek to de-stress and practice mindfulness throughout their busy days. Aside from stress-reducing activities, the apps also provide sleep aid features in a non-pill form.

Mental wellness and meditation apps are expected to continue to grow in the coming years, according to AdQuantum.

The pandemic put a much-needed spotlight on the importance of mental health and has since had long-lasting effects. As AI and machine learning make continued advancements, consumers will likely find meditation (as well as health and fitness apps) becoming more fine-tuned and tailored to their needs and preferences.

The great outdoors has also seen a resurgence in light of the pandemic. While many hikes were crowded during the lockdown and cycling shops couldn’t keep up with inventory, apps continue to play a major role in the lives of fitness and wellness enthusiasts.

The report reveals two apps have gained significant popularity post-lockdown: Strava: Run, Ride, Hike and AllTrails: Hike, Bike & Run.

As consumers continue to engage in outdoor activities, Strava and AllTrails are along for the ride, offering databases of trails and routes, as well as progress tracking. Outdoor-themed apps are likely to see further enhancements due to their popularity.

The Latest Trends in Mobile Fitness Apps

Virtual coaches are an emerging trend in health and fitness apps, where consumers can receive guidance and support from virtual trainers. It should also come as no surprise that wearable tech has enhanced apps, motivating users to hit mile markers in their wellness journey.

Because of consumers’ connection with their fitness wearable, they’re likely to search for a health and fitness app that supports their chosen device.

The report also finds that by adding the element of gamification, such as rewards and challenges, consumers are more likely to engage with the app and stick with it for the long haul.

AdQuantum’s The State of the Health & Fitness App Market 2023 report can be viewed here.