In-Person Fitness Rebounds Post-Pandemic, IHRSA Report Finds

Members continue to return to gyms and studios in the U.S. and abroad, according to the 2023 IHRSA Global Report

IHRSA has released its 2023 IHRSA Global Report, an annual review of the health and trajectory of the global industry. The report, which includes data from a survey of IHRSA member health clubs, gyms, and studios as well as insights from federation leaders in 15 countries and industry partners, points to the resurgence of the fitness industry post-pandemic, with members continuing to return to gyms and studios in large numbers.

“This year’s report shows that health and fitness industry executives worldwide are optimistic about the trajectory of our industry,” said Liz Clark IHRSA President & CEO. “Consumers have gained a better understanding about the correlation between physical activity and better mental and physical health and well-being, which has led to a resurgence in people connecting and engaging in-person at health clubs and studios around the world.

IHRSA is a not-for-profit trade association representing the global fitness industry of over 200,000 health and fitness facilities and their suppliers. Founded in 1981, IHRSA maintains a leadership role in advancing physical activity. IHRSA’s mission is to grow, promote, and protect the health and fitness industry while providing its members with benefits and resources.

Here, Athletech News provides insights gleaned from the industry overview, trend, and survey data from the 2023 IHRSA Annual Global Report:

Key Takeaways:

- High Value/Low Price (HV/LP) and luxury fitness facilities gained the most over the past year.

- Top fitness companies reported strong YoY growth and fitness club expectations and public company data signal a favorable 2023.

- Leading studios rebounded after being hit the hardest during the pandemic. Today, boutique fitness accounts for 42% of all gym memberships.

- Franchising remained resilient during CVID due to the ability to leverage many owners to manage risk and challenges.

- AI, integration with healthcare providers, wellness services, pickleball and Gen Z are opportunities for the fitness industry; energy costs, new weight loss drugs, staffing and supply chain issues are challenges.

- Emerging markets in Asia Pacific, Middle East-North Africa (MENA), and Latin America-Caribbean are poised for growth.

Members Continue To Return to Clubs & Studios

Compared with a year ago, while the fitness industry was rebuilding from the pandemic, the outlook is more positive in most regions of the world as members continue to return to clubs and studios. In the US, research firm Placer.ai, which measures retail traffic in brick-and-mortar businesses and website visits, released its results for April 2023. Compared with April 2022, Placer.ai noted the following foot traffic trends for these major brands:

- Club Pilates: +25%

- Crunch Fitness: +20%

- Planet Fitness: +15%

- LA Fitness: Even

- Pure Barre: Even

High Value/Low Price & Luxury Fitness Facilities Flourish

The High Value/Low Price (HV/LP) business model gained the most over the last year, led by Planet Fitness. The company’s revenue increased by 27.6% year over year (YoY) in 2Q23 and grew its locations to 2,472 with more than 18.4 million members. Other HV/LP brands including Blink Fitness, EōS Fitness, VASA Fitness, Vivagym, Basic-Fit and PureGym had similar gains supporting that HV/LP fitness centers have found a larger audience post-pandemic. Luxury and high-end brands, such as Life Time, Equinox, VIDA Fitness, and Bay Club, also continue to experience a post-COVID resurgence.

Boutique Studios Rebound After Pandemic

Boutique fitness accounts for 42% of all gym memberships today, with an estimated growth of 17% by 2025. This is a rebound from the pandemic, when 30% of studios in the U.S. closed permanently in 2021. Studio members declined by approximately 22% from 2019 to 2021, according to the 2022 IHRSA Health Club Consumer Report.

Xponential Fitness, a leader in boutique fitness, reported its total members across North America grew by 29% YoY to 697,000 with sales of $341 million, a 37% increase over 2Q22. Other notable studios include [solidcore], a high-intensity, low-impact, strength workout on a Pilates-inspired reformer, which opened its 100th studio and plans to double its store footprint and expand internationally. Orangetheory Fitness expanded with 1,500 locations in 24 countries and plans to add 100 more locations this year.

Franchising Model Resilient During Pandemic

The franchise model showed resilience during the pandemic. Overall, fitness club revenues fell by about 30%, and 22% of facilities closed during COVID; comparatively franchise revenues declined by about 13% with approximately 10% of franchised facilities closing during the pandemic. Crunch Fitness is a notable leader in the sector and in 2020 the company thrived; its membership grew by 5.6% and the franchisor opened 40 new locations. Jim Rowley, CEO and partner at Crunch, attributes the company’s resilience to its ability to leverage its network of many different owners to mitigate and share risks and challenges.

Trends Shaping the Global Fitness Industry

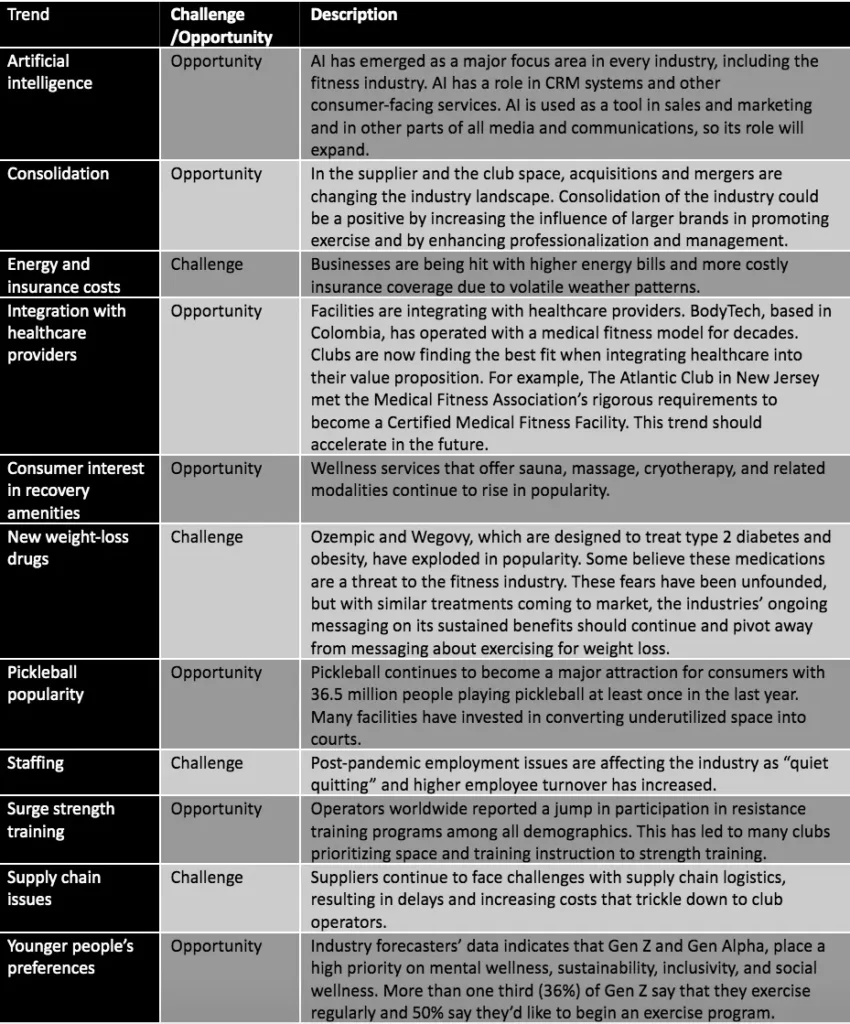

The IHRSA reported on the major trends which include both challenges and opportunities that are impacting the market, club management, and consumer behavior. Here the trends are summarized in Figure 1.

Figure 1. Trends Impacting the Fitness Industry

Source: 2023 IHRSA Global Report: Data and Insights on the Health and Fitness Industry

Better Years Ahead

IHRSA conducts an annual survey of its largest health member clubs and studios. Here are the findings derived from consumer insights, economic research, and data gathered from club operators through the annual IHRSA Global Report survey.

- Top Health Club Companies Recorded Strong YoY Growth in 2022

Despite a volatile economic environment, leading fitness club companies recorded strong performances in 2022. Topping global rankings in memberships, Planet Fitness reached an all-time high of 17 million members at the end of 2022, up 12% from 15.2 million in 2021. In Latin America, Brazil-based Smart Fit grew its member count by 26%, with approximately 3.8 million members at the end of 2022.

Leading fitness operators also added new locations. Anytime Fitness ended 2022 with more than 5,000 locations worldwide. Xponential Fitness ended 2022 with more than 2,600 locations, a 24% increase. Three other companies also increased their portfolios in 2022: Planet Fitness (+7%), Smart Fit (+15%), and Basic-Fit (+18%).

- Economic Headwinds & Operational Struggles Continue

A full recovery has not been reached in health club markets in the United Kingdom, Germany, Spain, and Japan. Emerging fitness markets are also contending with economic and regulatory headwinds. Small to medium-sized enterprises (SMEs) in the fitness industry have been harder hit in the post-COVID environment due to a tight labor market, high inflation, and high interest rates.

Some public companies struggled with recovery including Mexico-based Grupo Sports World and Curves Holdings Group, based in Japan. Other companies including Fitness First permanently closed its locations in Hong Kong, SoulCycle announced in 2022 that it would close 25% of its locations in the U.S.; F45 voluntarily delisted from the New York Stock Exchange in August 2023.

- Fitness Club Expectations & Public Company Data Signal Favorable 2023

Club fitness operator outlook and public company data are both positive indicators for the industry for the rest of 2023, though IHRSA reported that some caution is warranted with the macro environment facing some businesses. Four out of five (81%) of those surveyed by IHRSA expect membership to grow by more than 5% in 2023 relative to 2022. The same percentage anticipates that revenue will increase by more than 5%. The latest filings from public health club companies also indicate positive revenue outlooks.

- Consumer & Economic Impact Research Support a Favorable Long-term Outlook

The Global Wellness Institute forecasts the global market for physical activity to reach $1.1 trillion by the end of 2023 with significant growth coming from emerging markets in Asia Pacific, Middle East-North Africa (MENA), and Latin America-Caribbean. With many club facilities owned by the top 25 companies located in North America, Europe, and Australia, these regions represent opportunities. An IPSOS Global Tracker study found that across 50 territories worldwide, 86% of consumers are motivated to look after their physical health. This desire is highest among respondents from Asia, Africa, and Latin America. Thus, there is an opportunity for fitness businesses to leverage the drive for physical well-being as the economies, infrastructures, and per capita income of emerging countries improve.

The full 2023 IHRSA Global Report report can be found here.