Payments integrated into a connected tech ecosystem create a smoother experience for both the client and the brand.

In today’s fitness and wellness landscape, client experience is the battleground for loyalty. Operators pour resources into space design, staffing and programming but often overlook a critical, make-or-break moment — the payment experience.

One glitch at checkout or a clunky app interaction can sour an otherwise seamless visit, and in a market where one bad experience can cost a client, every contact point matters.

Especially for younger members raised on frictionless tech, the payment process isn’t just functional, it’s emotional. If it’s slow, confusing or outdated, it sends a signal that the brand is behind. If it’s intuitive, fast and connected to the rest of the user journey, it strengthens trust.

That’s why, for modern gyms, studios and wellness providers, payments aren’t just a back-end detail, they’re a front-line driver of retention.

Enter Mindbody Payments.

Built to meet the expectations of today’s tech-savvy, convenience-driven consumers, Mindbody’s integrated payment platform is reshaping how fitness businesses handle transactions. It does more than collect revenue, it elevates the entire client experience and helps businesses optimize every touchpoint along the way.

“Consumer expectations have evolved dramatically over the past few years,” says Kurtis Moyer, lead product manager at Mindbody. “In the fitness and wellness industry, members expect seamless and positive experiences – every time.”

That includes digital wallets, alternative payment methods, and accepting payments on mobile devices. With Mindbody, these aren’t futuristic features – they’re everyday essentials. The platform supports contactless payments across devices and channels, integrates with digital wallets like Apple Pay, and links directly to scheduling, marketing and CRM tools to enhance the entire client lifecycle.

Why Payments Drive Retention

It may seem like a small detail, but Moyer is quick to emphasize the real-world impact of optimizing the checkout flow.

“Payment processes might seem insignificant, but they’re an underestimated part of the client journey,” he says. “Strategic and innovative payment tools reduce friction at checkout, allowing for fast, professional transactions that leave a positive final impression.”

That final impression, he says, is the one that sticks, especially when paired with features like saved cards, auto-rebooking or flexible payment options like Buy Now, Pay Later (BNPL).

These tools not only make life easier for members but also remove barriers to future engagement.

“In a competitive market, eliminating barriers to access is essential for fostering repeat business and brand trust,” Moyer adds.

For members, this translates into speed and simplicity. For operators, it unlocks the kind of long-term loyalty that sustains business growth, even through seasonal lulls or economic uncertainty.

Mindbody’s true strength lies in its connectivity. Where legacy systems may bolt on payment tools as a separate solution, Mindbody weaves payments into its broader ecosystem of scheduling, marketing, CRM and membership management.

“The real magic happens when payments aren’t siloed – they’re part of a connected tech ecosystem,” Moyer explains. “Mindbody Payments is deeply integrated with tools for CRM, scheduling, memberships and marketing. This unification means a smoother experience for both the client and the operator.”

That means a client can book a class, pay with a stored method, earn loyalty points and get a personalized rebooking offer all without switching apps or interfaces. Operators, meanwhile, benefit from a full data loop that reveals lifetime value, behavior trends and opportunities for upselling or re-engagement.

“When your payment system is built into your larger workflow, it helps increase conversion rates and retention, and power the full customer lifecycle,” says Moyer.

Payments as a Brand Moment

Mindbody also sees payment interactions as an extension of the brand, not just a utility.

“Today’s digital wallets don’t just store payment info, they hold gift cards, loyalty programs and personalized offers,” Moyer says. “This shift turns what was once a functional step into an opportunity to deepen engagement and deliver value.”

In other words, the payment isn’t the end of the journey – it’s a chance to start the next one.

For businesses navigating seasonal spikes, class attendance dips or evolving member habits, flexible revenue tools are a lifeline. Mindbody Payments gives operators the ability to adapt in real time, supporting everything from spontaneous upgrades to low-cost ACH options and BNPL services.

“Mindbody Payments helps operators navigate the ups and downs of client activity by providing fast, flexible and lower-cost transaction methods,” says Moyer. “That frictionless experience can directly increase transaction value and drive incremental revenue.”

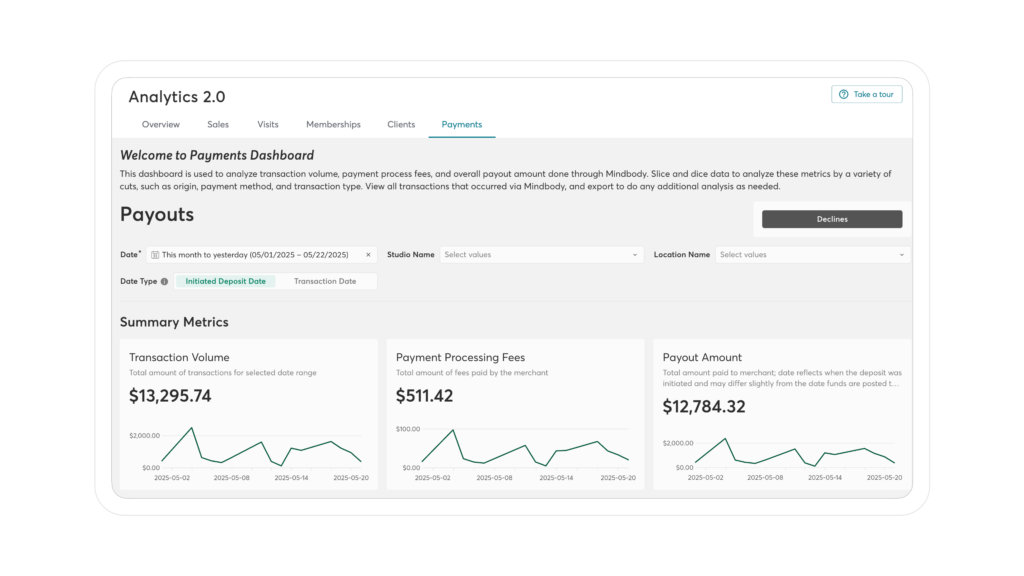

And with reporting features embedded in Mindbody’s Analytics 2.0 suite, users can monitor trends, fees and payout cycles without toggling between systems.

The Takeaway

As payment preferences continue to evolve, Mindbody is already tracking what’s next – from widespread adoption of tap-to-pay and QR code solutions to the expansion of digital wallets as loyalty hubs and even the potential of blockchain and direct bank payments.

Moyer encourages businesses to start preparing now.

“By embracing these trends early and leveraging platforms like Mindbody Payments that are designed with flexibility and innovation in mind, fitness and wellness businesses can stay ahead of the curve,” he says.

The most innovative fitness businesses don’t treat payments as an afterthought, they treat them as a differentiator. And in an industry where every interaction matters, choosing a platform that aligns convenience with brand loyalty and revenue optimization is more than a nice-to-have. It’s a necessity.