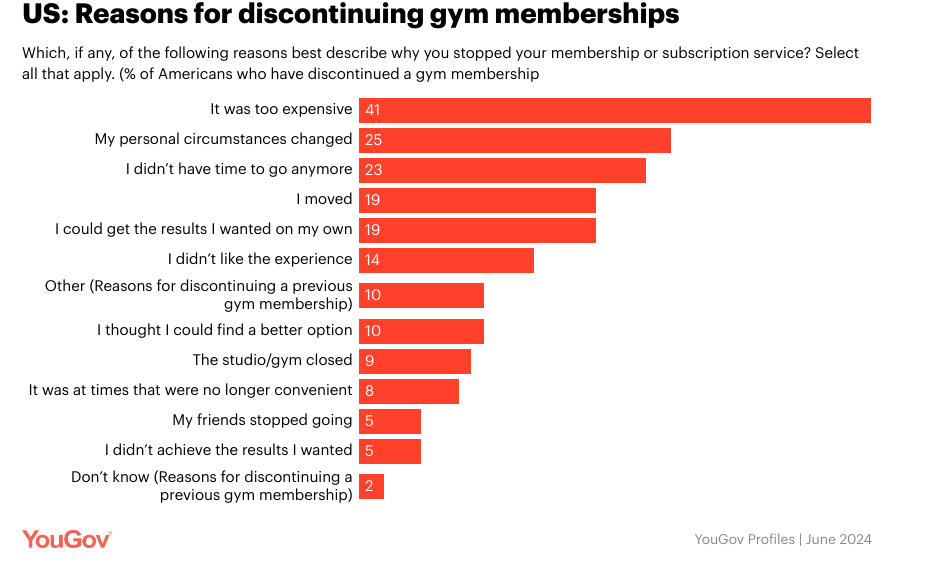

In a poll conducted by YouGov, cost was the most common reason people gave for canceling their gym memberships. The findings may help explain the surging popularity of low-price operators

Consumers may have grown more health-conscious and eager to hit the gym post-pandemic, but securing a budget-friendly spot remains a top priority, with new data from YouGov Profiles revealing that high membership cost is the leading cause of cancellations.

According to the survey, 41% of those polled by YouGov said they canceled their gym membership because it was “too expensive.” After that, 25% said they ended their membership due to a change in personal circumstances, while 23% indicated lack of time was a factor. Roughly a fifth of respondents (19%) said they nixed their membership because they shifted to a new location or because they couldn’t reach their fitness goals on their own (19%).

Other factors that contributed to cancellation were dissatisfaction with a gym experience (14%), seeking better options (10%), the gym or studio closing (9%) and inconvenient gym hours (8%).

YouGov Profiles also found that a social component seemed to impact keeping members engaged, as 5% of respondents said they cut ties with their gym because their friends stopped going. Another 5% shared that they canceled because they didn’t achieve their desired results, while 2% were unsure of their reasons.

It’s worth noting that the survey didn’t mention how much former gym members were paying for memberships they deemed too expensive, which may limit the YouGov poll’s effectiveness in helping operators plan pricing strategies moving forward.

Low-Price Gyms Surge

The findings from the market research and opinion polling leader serve as a warning for the fitness industry but appear to be encouraging for the longevity of high-value, low-price (HVLP) gyms. Leading HVLP brands such as Planet Fitness, Crunch Fitness, EoS Fitness and 24 Hour Fitness saw high usage numbers in the first four months of 2024 amid steady growth for the HVLP category.

The survey comes as HVLP fitness operators have made strides to enhance the big-box membership experience with increasingly high-end amenities, including wellness and recovery experiences.

Crunch, which is eying its biggest year yet in 2024, is bulking up its recovery and tech areas to drive engagement, such as a partnership with Amazon One to deliver a frictionless entry for members) and new ‘Relax & Recovery’ programs.

“We believe recovery is emerging as a noteworthy trend as more consumers begin to understand its importance for health and longevity – from reducing the risk of injury to enhancing performance and promoting overall well-being,” Crunch president Chequan Lewis told ATN. “For many fitness enthusiasts, recovery will become a fundamental component of their fitness regimen.”

Chuze Fitness, an emerging HVLP operator with 50 gyms and counting, is keeping the pulse on fitness trends that have captured the interest of gym-goers, such as free weights and mind-body options such as infrared heated yoga and Pilates.

Another fast-growing HVLP operator, EoS Fitness, is investing in its gyms this year, including Hyperice recovery technology products and assisted stretching services at some locations.

Like EoS, Blink Fitness, an HVLP operator owned by Equinox, is investing millions in its most heavily trafficked gyms, which includes recovery technology from Hyperice and WellnessSpace Brands.

There’s Still Room for Luxury

Despite the findings from YouGov, several high-priced operators are experiencing strong growth in terms of physical locations and memberships.

Life Time, an athletic country club operator with an average monthly member due of nearly $190, has over-performed as far as membership growth. Waitlists have become a common occurrence at Life Time clubs; the brand credits its pickleball offerings and group fitness classes, among other factors, with driving demand.

Luxury lifestyle and fitness brand Equinox reported a 27% revenue increase and record-high member engagement in 2023, with 25-plus new locations planned for the coming years.