Peloton’s New CEO is More of the Same, Says Blackwells Capital – Again Urges Board to Sell Fitness Company

Blackwells Capital LLC is not impressed with Peloton’s new CEO & says the fitness giant can be “reimagined”

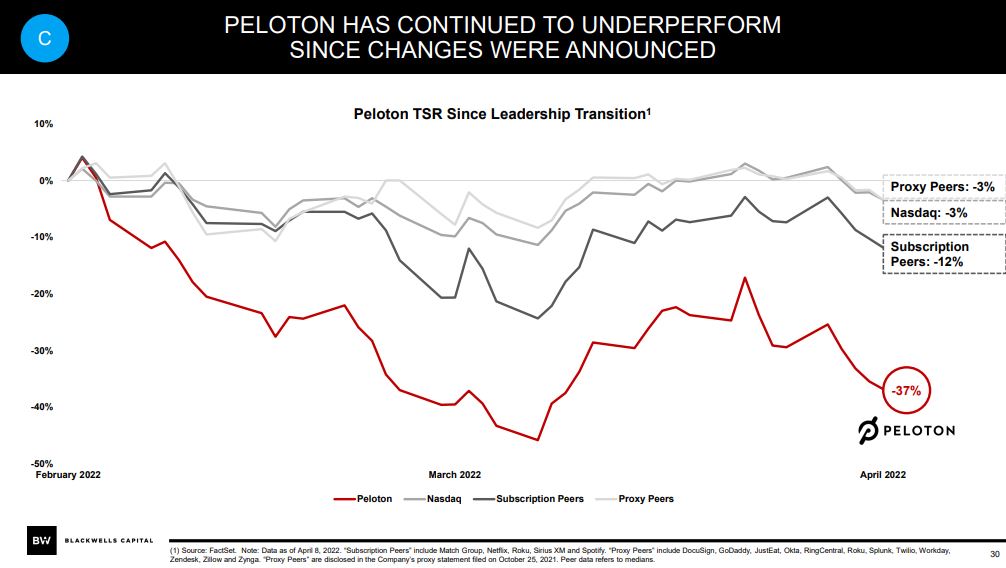

Barry McCarthy, Peloton’s new CEO, is more of the same, and his first 60 days have cost shareholders nearly $2 billion in lost market value, says Blackwells Capital. The alternative investment management firm, a shareholder of Peloton, published a presentation outlining Peloton’s ongoing leadership deficiencies.

This isn’t the first time Blackwells has criticized Peloton’s management. The firm, led by Chief Investment Officer Jason Aintabi, demanded the resignation of then-CEO John Foley in a scathing letter earlier this year.

Blackwells has issued a warning this time, stating that if Peloton does not commit to taking “responsive action,” the firm will pursue all available avenues to hold the fitness company and individual Board members accountable.

And, unlike the January letter, which some criticized as a performative distraction, Blackwells appears to have carefully crafted a 71-page presentation outlining the firm’s argument with well-thought-out recommendations for the interactive fitness company.

Simply put, Blackwells says that McCarthy failed to make meaningful changes, that inventory management and quality control continue to plague Peloton, and that “underqualified legacy directors” fail to provide adequate oversight.

“Two months since Peloton hired one of the highest paid CEOs in all of corporate America, nothing has fundamentally changed. Peloton’s powerful brand, proprietary technology, engaging instructors, and fiercely loyal subscriber base can be shaped into a much more attractive business. But this cannot happen effectively in the public markets, especially with the current leadership in place,” Blackwells states in the opening of the presentation.

However, Blackwells says Peloton is a strategically valuable asset that is attractive to many potential acquirers and that there is a chance to “reimagine” Peloton. The difficulty, Blackwells maintains, is transitioning to a more optimal model while remaining public.

Blackwells questions if McCarthy was properly vetted to become Peloton’s new CEO & John Foley’s presence remains a “distraction”

Blackwells says that McCarthy’s appointment to CEO of Peloton was too rushed, referencing his own admission that it was like a “shotgun marriage” and that McCarthy was happily retired before being called to lead Peloton. The firm also points out that as a first-time public company CEO, McCarthy is earning approximately four times as much as former CEO John Foley.

While Peloton terminated close to 3,000 employees to reduce costs, McCarthy was one of the highest paid executives in the US, says Blackwells. The firm suggests that his compensation package may be due to his close ties to Jay Hoag, Chair of Peloton’s Compensation Committee.

And even though former CEO Foley stepped down, Blackwells calls him a “distraction” who “continues to wield excessive influence.” Blackwells also takes issue with Peloton’s dual-class voting structure and Foley selling approximately $50 million in Peloton shares to an investment firm.

“Blackwells believes Mr. Foley’s recent stock sales (possibly made under financial duress) may be creating a greater imbalance between insider voting power and economic interest,” a slide reads from the presentation.

The firm suggests that Foley listing his Hamptons mansion for sale only months after purchasing it could signal financial troubles.

Suitable acquirers

Blackwells examines the big names that could be strategic acquirers of Peloton, like Amazon, Apple, Google, Nike, Warner Brothers, and Netflix. Such giants have complementary businesses with existing user bases and the fitness company would fit within product and service ecosystems including wearables, points out the investment firm.

Being a household name isn’t enough & Peloton should be software focused, says Blackwells

Blackwells urges Peloton to dominate the connected fitness space by increasing offerings to become a “one stop shop” in the connected fitness category and focus on becoming a leader in fitness-as-service.

Another suggestion is to create a universal fitness platform, which Blackwells refers to as “Powered by Peloton,” where integrating Peloton software with any piece of fitness equipment will help the company expand to other markets like hotels, hospitals, offices, and schools.

The presentation also takes aim at the Peloton Guide, as Blackwells says that they don’t believe Peloton should “blindly pursue hardware product launches with little strategy” but should instead focus on its signature interactive bike while exploring strategic partnerships with hardware vendors.

Aintabi releases statement

Aintabi released the following statement, addressing the ongoing grievances with Peloton’s new leadership:

“Two months have passed since John Foley was promoted into the role of Executive Chairman and Barry McCarthy came out of retirement to assume the post of CEO. Remarkably, shareholders are worse off now than before. Having provided Mr. McCarthy a $275 million sign-on compensation package, they remain at the whim of former CEO John Foley, who appears financially distressed – and a forced seller of the Company’s stock – even while he still controls the Company.

Meanwhile, shareholders have lost a further $2 billion in market value.

Peloton will continue to be poorly valued for as long as a close-knit group of insiders, who have proven themselves incapable of creating value, continue to wield voting power far in excess of their economic interest. No shareholder should want Mr. Foley to still sit atop the management pyramid or control the Board through his super voting-stock. He lost his entitlement to both positions when he destroyed $40 billion of shareholder wealth in less than a year.

Peloton’s powerful brand, proprietary technology, engaging instructors, and fiercely loyal subscriber base can be shaped into a much more attractive business. But this will not happen effectively in the public markets, especially for as long as Mr. Foley – who has proven utterly unable to manage Peloton or his own financial affairs – maintains control through his super-voting shares.

Blackwells calls upon Mr. Foley to recognize his own limitations and the dampening effect his control has on public market investors by immediately eliminating the dual class structure. Blackwells continues to believe that Peloton cannot be controlled by an Executive Chairman who appears to be under extreme duress, and will pursue all remedies available to it and to all shareholders.”

The full Blackwells presentation can be viewed here.