Headspace Secures $105M in Debt Financing Following Layoffs

The mental health platform will explore in-person clinical care, increased substance use disorder support and employee assistance programs

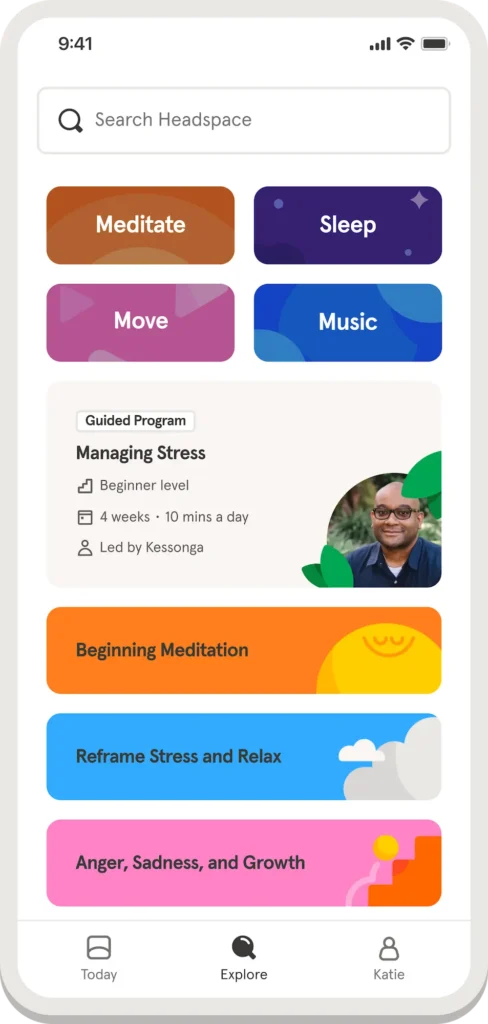

Headspace Health, a mental health and meditation app company, has received $105 million in new debt financing from Oxford Finance. The proceeds will support the expansion of Headspace’s mental health platform and enable the company to be “opportunistic” in investing in areas with a market need, it said.

The new funding comes on the heels of a round of layoffs at Headspace, which saw 15% of its staff receiving pink slips. The mental health company laid off 4% of its staff at the close of 2022.

“This financing puts us in a strong position to expand our enterprise EAP offering and accelerate our ability to bring our mental healthcare services to more health plans and directly to consumers in the coming year,” said Russell Glass, CEO of Headspace.

The wellness platform has attracted over 4,000 employers in 200 countries, providing employees with mental health and well-being support.

Headspace has been hearing demand from its customers, partners and members for continued investment in in-person clinical care, increased substance use disorder support and employee assistance programs, areas that the digital health platform says it will be examining in the near future as potential areas for “deeper investment,” according to Behavioral Health Business.

Regarding the June layoffs, The Los Angeles Times reported that the company’s internal memo, penned by Glass, explained that Headspace had “underestimated” how much the current economic environment would impact consumer behavior and stated the company is committed to being cash-flow positive in 2024. The memo also touched upon upcoming initiatives, including an AI-powered journaling feature.

Headspace merged with Ginger, an online mental health company, in 2021 in a deal that valued the combined company at $3 billion.

Courtney Rehfeldt has worked in the broadcasting media industry since 2007 and has freelanced since 2012. Her work has been featured in Age of Awareness, Times Beacon Record, The New York Times, and she has an upcoming piece in Slate. She studied yoga & meditation under Beryl Bender Birch at The Hard & The Soft Yoga Institute. She enjoys hiking, being outdoors, and is an avid reader. Courtney has a BA in Media & Communications studies.