Nautilus Sells Non-Core Assets For $13M, Reports Post-Pandemic Sales Decline

Nautilus CEO Jim Barr said the lower sales numbers were expected and were driven primarily by a return to pre-pandemic demand

Nautilus is selling $13 million in non-core assets in an effort to boost its balance sheet after the fitness company reported preliminary fourth-quarter and full-year fiscal 2023 results that showed a steep drop in net sales.

The manufacturer of brands such as Bowflex, Modern Movement, Schwinn Fitness and Universal Gym Equipment has been employing its ‘North Star’ strategy, a long-term plan that Nautilus has implemented.

Nautilus CEO Jim Barr indicated that the strategic review is ongoing as the Washington-based fitness company continues to assess any opportunities that may accelerate its transformation.

Earlier this year, the connected fitness equipment manufacturer announced it would reduce its workforce by approximately 15% as a cost-savings measure.

Nautilus had previously discussed a potential sale last fall, with its board of directors hiring Evercore as a financial advisor.

Nautilus exceeds expectations, but sales are down

For the fiscal fourth quarter that ended March 31, Nautilus expects to report net sales of $68.4 million compared to $119.7 million last year, based on preliminary, unaudited results announced Tuesday. The fitness company says the sales decline is driven primarily by the return to pre-pandemic demand.

Nautilus says it focused on significantly reducing its branded inventory in the quarter and that excluding sales of Nautilus-branded equipment, net sales for Q4 2023 are expected to be $62.0 million.

For the twelve months that ended March 31, Nautilus expects to report net sales of $286.8 million (versus guidance of about $270 million) compared to $589.5 million last year.

As indicated for Q4, Nautilus says the return to pre-pandemic demand again drove the sales decline. Excluding sales of Nautilus-branded equipment, net sales for FY 2023 are expected to be $274.8 million.

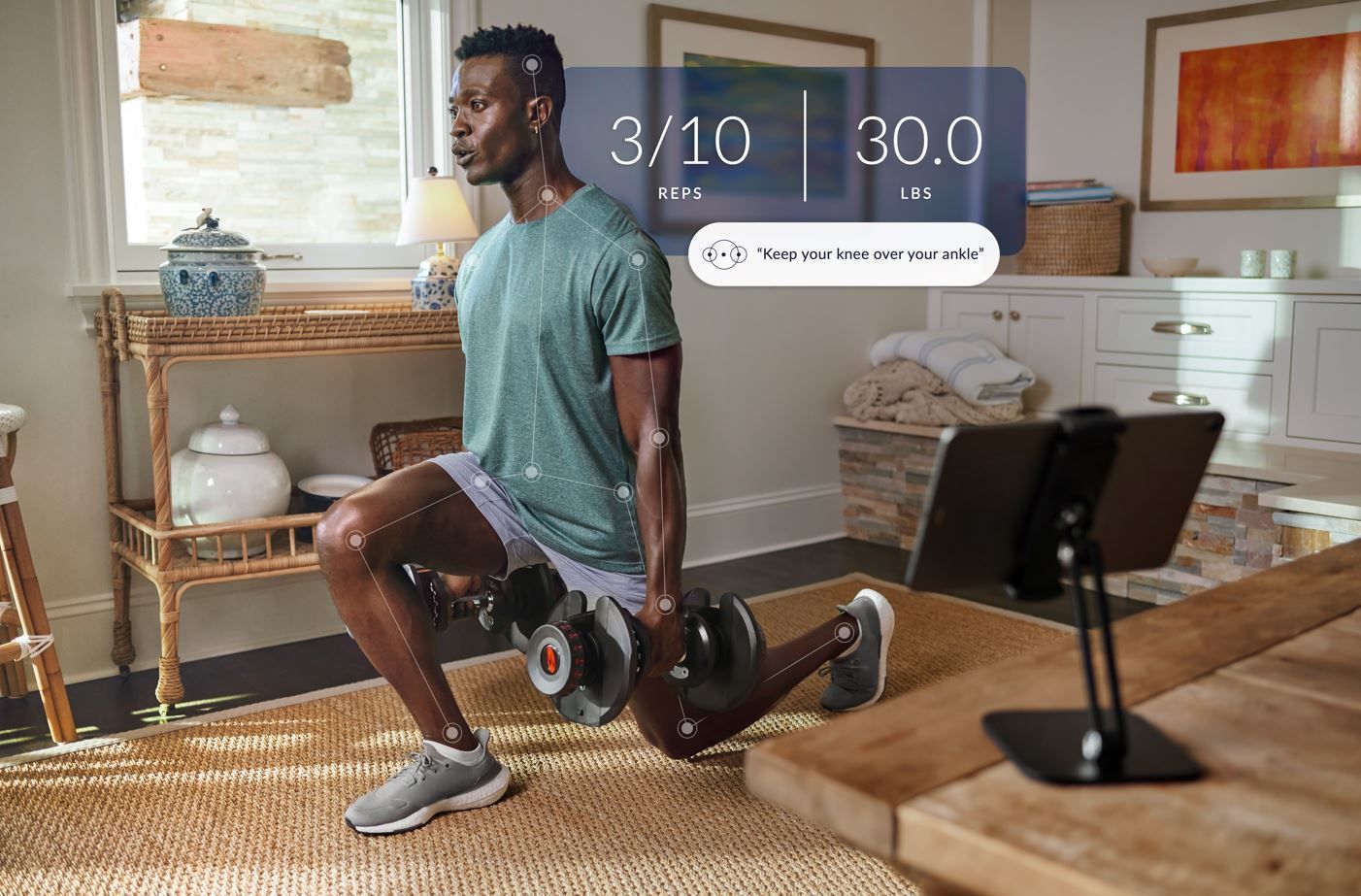

As for JRNY, the company’s digital fitness platform, Nautilus reports it has approximately 500,000 members as of March 31, in line with guidance. The JRNY platform and app had undergone a significant overhaul to become a critical maneuver in the company’s connected fitness journey.

“I am proud to announce results that exceeded our expectations,” Barr said of the preliminary results.

“Continued demand in our direct business during the fourth quarter as well as continued outstanding inventory management and cost-control initiatives, enabled us to deliver solid results for Q4 and fiscal year 2023,” he said. “We are also pleased by the strong momentum of our differentiated digital offering, having achieved our growth targets for JRNY members by the end of the fiscal year.”

In an interview with Athletech News last summer, Barr indicated three trends for the fitness industry: connected fitness is here to stay, fitness has gone hybrid and a more holistic view of fitness and wellness is evolving.

Asset sale

One move to enhance Nautilus’ balance sheet is the sale of non-core assets for approximately $13 million in cash, which the connected fitness company says it has completed.

The sale includes the Nautilus brand trademark assets and related licenses, which the company says will continue to streamline its focus and provide additional financial flexibility.

Nautilus used the net proceeds of the sale to pay down a portion of its term loan.

“The sale of these valuable, but non-core assets, including the Nautilus brand, which has been de-emphasized in our transformative North Star strategy, position us well to continue to capitalize on long-term growth in consumer demand for at-home fitness,” Barr said.

Enhanced credit agreement

Nautilus has also enhanced the terms of its credit agreement for its existing revolving credit facility.

Under the new deal, the connected fitness company has reduced the revolver commitment from $100 million to $60 million. Nautilus also confirmed that it has paid down the outstanding amounts on the revolver and there are currently no outstanding borrowings.

“With the improved financial flexibility from the sale and enhancements to our balance sheet, we’re confident in our ability to manage through the current environment and continue our path to becoming a leader in connected fitness,” Barr said.

Nautilus is confident moving forward

While the fitness manufacturer has faced challenges post-pandemic, Barr is still confident about the 35+ year-old company, telling the Portland Business Journal that many of the issues Nautilus is facing are due to short-term headwinds, including supply chain disruptions.

He believes the retail channel will remain a long-term component of the company’s business model as the macro environment stabilizes, explaining that even though many fitness enthusiasts have returned to the gym, Nautilus’ research shows that many still prefer home workouts on Nautilus equipment.

Based on those findings, Barr revealed that Nautilus is gearing up to release more equipment and programs focused on hyper-personalization.

The target consumer has also shifted.

“We went after a new consumer for whom exercise is more important. We were over-indexed on a group that we had to get off the couch … and (for whom) exercise was some kind of a chore. And it turned out that was a great target segment to go after,” Barr told the publication in March.

The connected home fitness provider plans to report its results in full on May 23.

Correction: A previous version of this article mistakenly referred to Octane Fitness as a Nautilus-owned brand. TRUE Fitness purchased Octane from Nautilus in 2020.