Gym and studio brands saw significant revenue increases while connected fitness and equipment companies struggled in Q2

Athletech News’ Q2 2023 Earnings Insights report highlights trends that the major publicly traded fitness companies reported for the quarter ended June 30, 2023.

Here we focus on revenue, fitness center openings, memberships, strategic initiatives, and company revenue outlooks across six public fitness companies spanning fitness centers and studios to connected fitness and equipment companies

Note that Nautilus refers to the quarter ending June 30, 2023 as 1Q24 and Peloton refers to this quarter as 4Q23; for sake of comparison, we are referring to this quarter as “2Q23” throughout this report and are comparing the quarter ending June 30, 2023 for each of the companies.

Key Takeaways:

- Revenue increased across the combined three major fitness centers, Lifetime Group Holdings (Life Time), Planet Fitness, and Xponential Fitness by 24.2% year over year (YoY), with Xponential Fitness reporting the highest revenue growth of 29.9% from 2Q22 to 2Q23.

- Revenue declined across the three connected fitness and equipment companies, Beachbody, Nautilus, and Peloton by a combined 10.3% YoY. The most significant declines were due to dampened demand for equipment, most notably bikes.

- Fitness centers are expanding their portfolios. Xponential Fitness, with over 10 boutique studios in its portfolio, is expanding the most aggressively and plans to add 540 to 560 centers by the end of 2023.

- Membership rates and subscriptions are increasing at nearly all the fitness centers and connected fitness equipment companies.

- Strategic priorities include brand expansions on Amazon, rebranding, product launches, partnerships, loyalty programs and store expansions.

- Revenue outlooks for the fitness centers for fiscal year 2023 are between 12.0% to 23.4% over 2022 revenue.

Strong Revenue Growth at Fitness Centers Driven by Franchise Revenue, New Members & Same Store Sales

Xponential Fitness reported the strongest revenue growth YoY of the fitness centers at 29.9%, closely followed by Planet Fitness at 27.6% and Life Time at 21.8%.

Life Time revenue increase was driven by a 25% increase in membership dues and enrollment fees and a 13% increase in in-center revenue. The company’s same store sales were 15.5% in 2Q23, the highest of the three fitness centers

Planet Fitness revenue increase was driven by corporate owned store revenue increases of 12.1% YoY due to a same store sales increase of 10.2%, new store openings and the acquisition of 4 stores in Florida; franchise revenue increased due to royalty revenue and a same store sales increase of 8.6% and equipment segment revenue increased by 82.6% YoY due to higher equipment sales.

Xponential Fitness revenue growth was driven by royalty revenue at its largest segment, franchise revenue, as member visits “reached all time highs.” Same store sales were 15.0% in the quarter. Other revenue increased 62% YoY which includes B2B partnerships and XPass, XPlus and company-owned studios.

Figure 1. Fitness Center Revenue 2Q22 and 2Q23 ($M; YoY % Change Right Axis)

Source: Company reports, Capital IQ

Revenue Declines at Connected Fitness/Equipment Companies Mainly Due to Lower Demand for Cardio Equipment

Beachbody had the steepest revenue decline YoY, attributable to a decline in its subscription revenue which accounts for over 95% of its total revenue. The company’s connected fitness bike revenue declined by 51.9%; the company delivered 5,500 bikes in 2Q23 compared to 8,800 bikes in 2Q22.

Nautilus equipment sales were down by 23.8% overall and in the direct and retail segments, down by 17.5% and 29.0% respectively. Cardio sales equipment was down in both segments primarily driven by lower customer demand for bikes, while strength products declined by 34.9% in the retail segment due to lower demand for weights.

Peloton total revenue declined by 5.4% YoY driven by a 25.4% decrease in its connected fitness revenue. Notably, its subscription revenue segment increased by 10.1%.

Figure 2. Connected Fitness and Equipment Company Revenue 2Q22 and 2Q23 ($M; YoY % Change Right Axis)

Source: Company reports, Capital IQ

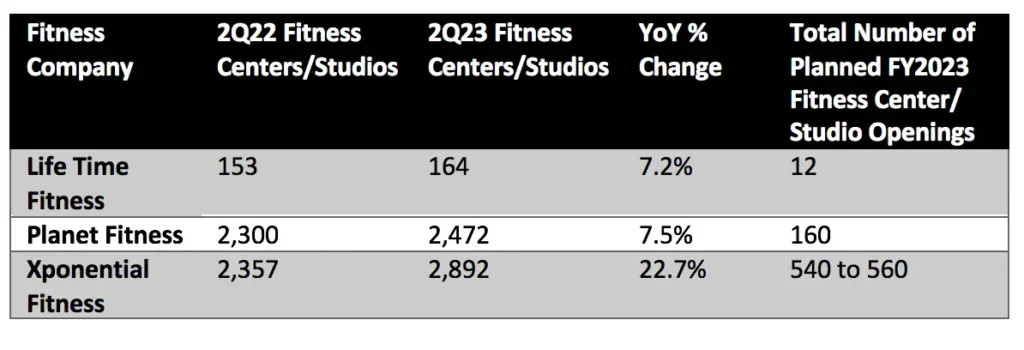

Fitness Centers Are Expanding Their Portfolios, With Xponential the Most Aggressive

Life Time has the smallest fleet with 164 clubs at the end of 2Q23; the company opened 11 stores since 2Q22, representing 7.2% growth, and plans to open 12 clubs by year-end 2023, with eight new centers planned for the second half of the year.

Planet Fitness has expanded strongly, with 7.5% growth from 2Q22 to 2,472 centers. The company plans to add a total of 160 new Planet Fitness centers in 2023.

Xponential Fitness grew its store base by 22.7% YoY to 2,892 studios and plans to expand by 540 to 560 studios in 2023 representing the highest number of studio openings in the company’s history. The company sold 234 franchise licenses globally in 2Q23 bringing its total sold licenses to 5,872.

Figure 3. Fitness Centers/Studios in 2Q22 and 2Q23 and Planned FY2023 Centers/Studios Openings

Source: Company Reports, Capital IQ

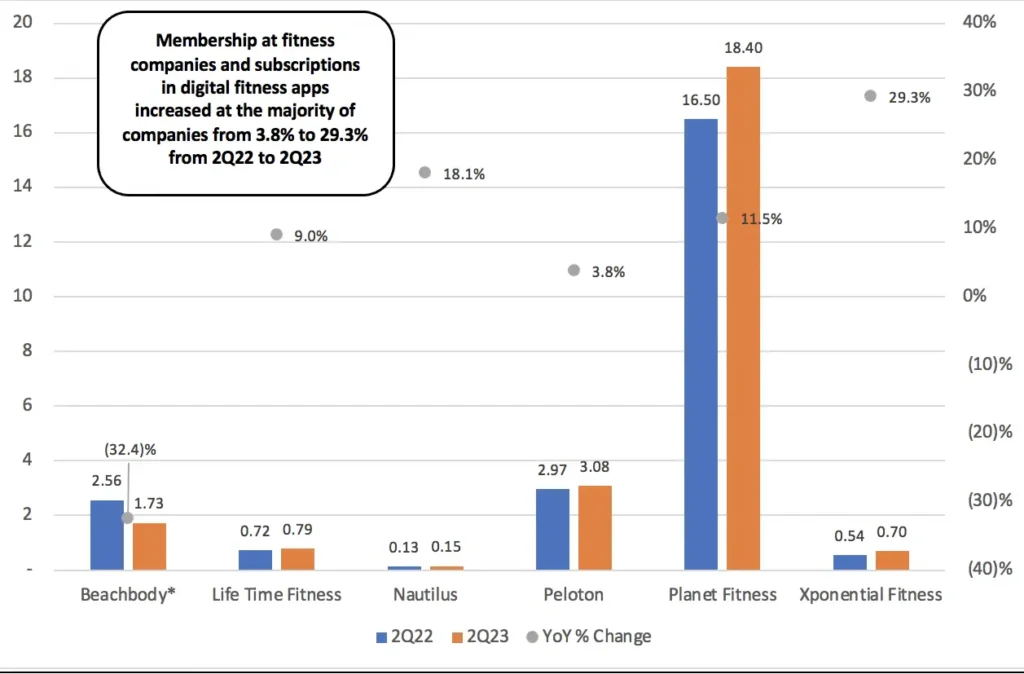

Memberships Grew at Fitness Centers and at the Majority of Connected Fitness/Equipment Companies

Membership increased at the major fitness companies from 2Q22 to 2Q23 as shown in Figure 4; Life Time added 65,450 members, Planet Fitness added 1.9M members and Xponential Fitness added 158,000 members.

Life Time highlighted that June 2023 was the first month that its attrition rate was below 2019 (pre-pandemic).

Planet Fitness net membership grew by more than 300,00 during the quarter led by Gen-Z membership growth.

Xponential Fitness management said that North America visitation rates grew by 32% YoY.

At the connected fitness and equipment companies, Beachbody reported 830,000 fewer subscribers, Nautilus added 23,000 subscribers and Peloton added 112,000 subscribers from 2Q22 to 2323.

Beachbody transitioned to a consolidated digital platform including fitness, nutrition and personal development with a premium subscription price; existing customers have renewed at approximately 60%.

Nautilus’ JRNY is an AI-powered connected fitness and coaching platform across its BowFlex connected products. The recent launch of a lower-priced, digital-only JRNY featuring rep counting, form coaching, and strength training has been well-received.

Peloton introduced a tiered App subscription and saw a higher mix of higher-priced App tier members than expected. While connected fitness subscriptions grew, total members declined by 5% YoY to 6.5M members due to a slowdown in hardware sales and a seat post recall.

Figure 4. Membership at Fitness Centers and Digital Fitness Subscriptions at Connected Fitness/Equipment Companies in 2Q22 and 2Q23 (M; YoY % Change Right Axis)

*Includes fitness and nutritional subscriptions

Source: Company reports, Capital IQ

Strategic Initiatives: Rebranding, Product Launches, Customer Experiences, Store Expansion & Partnerships

Beachbody: The company held a Partner Leadership Summit, attended by approximately 12,000 coaches and partners, to train partners on its new body premium solution, and “Healthium” category. The company is piloting new strategies including launching a free preview tier in 3Q23 and expanding its nutrition portfolio on Amazon in 4Q23.

Life Time: Management reported that its customer is interested in the experience and has been insensitive to the price. Therefore, the company’s priority is 100% committed to delivering on that brand experience.

Nautilus: Ahead of the holiday season, the company is launching new connected fitness equipment including BowFlex C6 SE, the new Max SE, and an elliptical under the Schwinn brand. Nautilus is rebranding by the end of the calendar year.

Peloton: Peloton reaffirmed the goals it outlined for investors in February 2023 with an overarching goal of restoring Peloton’s growth by “leaning into the future of tech-enabled fitness.” The brand relaunched on May 23rd which included introducing new App subscription tiers, launching a global partnership initiative with multiple sports franchises, and re-architecting its commercial strategy.

Planet Fitness: The company is launching a study to reevaluate the 4,000 total domestic fitness store opportunity that it established at its IPO in 2015. Planet Fitness reported that the opportunity could be higher due to its ability to achieve a greater penetration of users at different generations combined with the industry consolidation caused by COVID.

Xponential Fitness: Xponential plans to explore additional B2B partnerships and enhance XPass and XPlus offerings in the second half of 2023 including introducing an advertising channel into the XPass app in categories such as mental health, apparel, and healthy foods.

Fitness Centers are Reporting Strong Outlooks for 2023; Connected Fitness/Equipment Companies Are Conservative

Life Time expects revenue to be $2.235B to $2.265B for the year, 23.4% over 2022.

Planet Fitness expects its revenue to increase by approximately 12% for the full year.

Xponential Fitness raised its outlook for its revenue to $295M to $305M, an increase of 22% over 2022.

Beachbody provided an outlook for 3Q23 only with revenues of $120M compared to $130M in 3Q22, a decrease of 7.7%.

Nautilus provided a full-year outlook with net revenue expected to be $270M to $300M, between (5.6)% to 4.9% over prior year revenue of $286M.

Peloton provided guidance for the next quarter, with revenues of $580M to $600M, a decrease of 2.7% to 5.9% compared to $616.5M in the comparable year-ago quarter.