Health Data Game Changer: LexisNexis Risk Solutions Enters Agreement to Acquire Human API

The definitive agreement to acquire Human API, a provider of health data, will enable LexisNexis to deliver innovative solutions while meeting regulatory requirements and data privacy standards

LexisNexis Risk Solutions, a division of RELX, has entered into a definitive agreement to acquire Human API, a management platform that connects consumers, life insurance companies, and healthcare organizations.

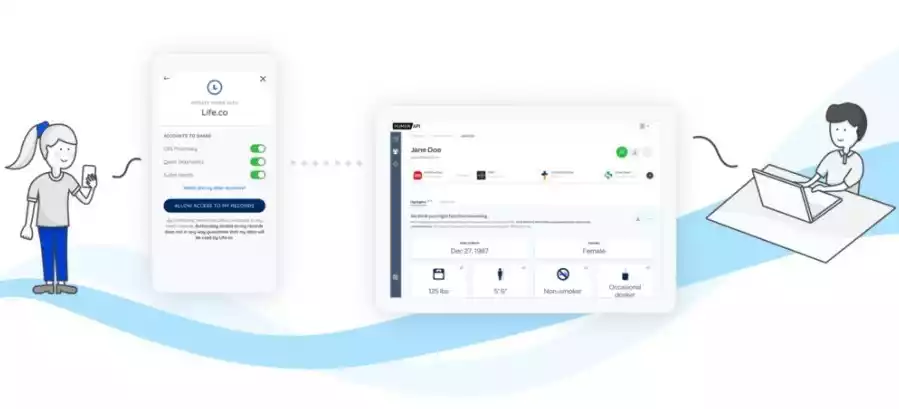

Human API enables consumers to easily connect and consent to using their health data, allowing insurance companies to receive the information required to offer life insurance and support automation of the underwriting process.

The health data provider says its proprietary health intelligence platform will remain the driver facilitating the acquisition and delivery of consumer-approved health information, adding that its approach improves care coordination within the healthcare ecosystem.

With the acquisition of Human API, Georgia-based LexisNexis Risk Solutions says it will further its strategic goal of delivering innovative solutions while meeting industry regulatory requirements and data privacy standards.

“We are incredibly excited about this milestone and what it will help drive for our customers and partners,” Human API wrote of the LexisNexis Risk Solutions acquisition. “We will continue to, and remain committed to, providing our clients with advanced technology solutions and exceptional delivery services.”

The health data company noted that completion of the deal is subject to customary conditions.

“During this period of review we ask for your patience. Human API will continue to operate fully independently and be compliant with regulatory requirements,” the company wrote on its site.

Human API announced at the end of 2022 that it had partnered with New York Life Insurance Company. The collaboration enabled New York Life to gain greater access to digital health data, furthering efforts to improve the consumer experience when purchasing life insurance.

The health data provider raised over $20 million in a Series C funding in 2020. The funding round included participation from Samsung Ventures, CNO Financial Group, Allianz Life Ventures, and Moneta VC, and existing investors BlueRun Ventures, SCOR Life and Health Ventures, and Guardian Life Insurance Company.