Fitness & Wellness Execs Are Mostly Optimistic, Citing High Consumer Demand

ATN breaks down some key findings from Mindbody’s State of the Industry report, including why operators are optimistic despite concerns like inflation, and why AI isn’t taking away fitness and wellness jobs

Fitness and wellness operators are mostly optimistic about the current state of the industry, pointing to increased consumer demand that they believe will outweigh macroeconomic concerns like inflation, according to a new report from software giant Mindbody.

In its 2025 State of the Industry report, Mindbody surveyed 1,421 global decision-makers across fitness and wellness, including fitness studios, spas, salons and integrative health solutions. Their responses were benchmarked against a survey of over 1,000 business owners from other industries.

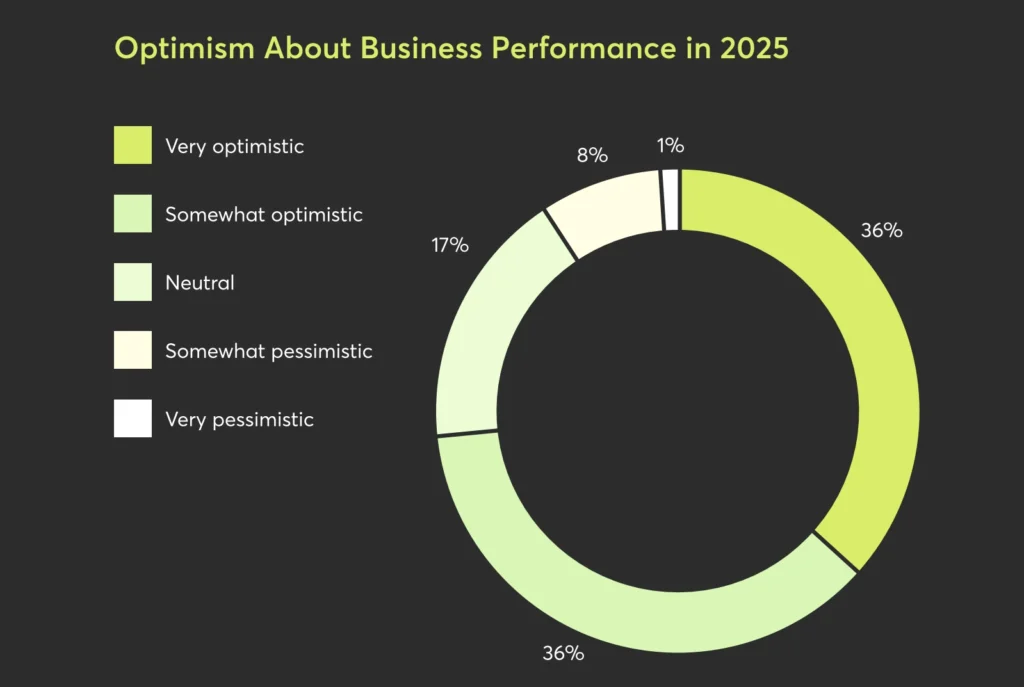

Of those surveyed, 72% of fitness and wellness operators said they were optimistic about business performance in 2025, with 36% saying they were “very optimistic” and another 36% “somewhat optimistic.”

Conversely, only 9% of operators said they were pessimistic.

“Within the industry, optimism seems tied to a long-term cultural shift: consumers now treat fitness and wellness less as a luxury and more as a lifestyle priority,” the report’s authors wrote.

AI Isn’t Coming for Fitness & Wellness Jobs

According to the report, fitness and wellness brands are starting to embrace artificial intelligence, primarily using AI for marketing (44%) and customer service uses such as chatbots and automated response systems. (17%).

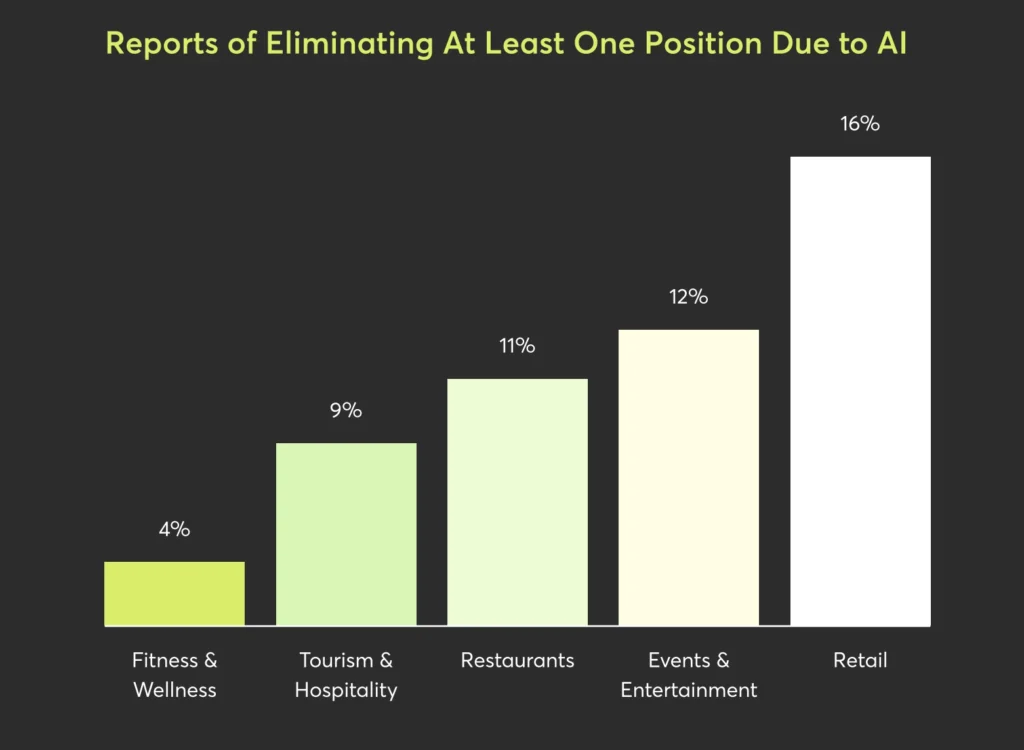

In a piece of good news for fitness and wellness workers, only 4% of businesses said they planned to cut staff due to AI. This figure was significantly lower than it was in other industries like retail (16%), events and entertainment (12%), restaurants (11%) and tourism and hospitality (9%).

The sharp difference could be due to the fitness and wellness industry’s focus on the human element, the Mindbody team posited.

“AI may streamline operations and sharpen decisions, but even early AI adopters agree it’s never going to be a substitute for human connection,” the report’s authors state. “Many roles across the industry require empathy and expertise that can’t be automated away.”

Brands Eye New Revenue Streams & Personalization

Faced with increased competition and a challenging macroeconomic environment marred by inflation, fitness and wellness brands are eyeing new revenue streams to supplement core money-makers like classes and memberships.

One in three fitness and wellness businesses surveyed said they planned to add retail elements through apparel, supplements, or equipment.

Meanwhile, 29% of brands said they’re looking to boost revenue through events and retreats, a potentially lucrative opportunity as people seek in-person connection.

When it comes to keeping their current members, fitness and wellness brands plan to lean into personalization. A whopping 56% survey respondents cited “personalized outreach” as a top retention strategy.

Loyalty programs are also gaining ground, the report found, with 21% of brands citing them as a primary tactic for retention (spas and salons were significantly more likely to adopt loyalty programs as an engagement strategy compared to fitness studios, it’s worth noting).

Instagram Is King. TikTok Has Some Work To Do

When it comes to acquiring new members, it’s all about the Gram.

Instagram is by far the most popular client acquisition tool for fitness and wellness brands surveyed by Mindbody, with 63% of respondents identifying it as their most effective tool for bringing in new business.

Facebook and Google/SEO tied for second (42%), while email marketing came in third (21%).

TikTok notably lagged far behind the others, with only 7% of brands citing the popular short-form video content platform as their most effective tool for acquiring clients.

“Despite TikTok’s cultural prominence, it has yet to prove effective in client acquisition for this sector. … This indicates a potential opportunity for studios seeking to reach younger audiences,” the report’s authors noted.

To view Mindbody’s 2025 State of the Industry Report in full, click here.