Fitness apps outperform other categories when it comes to monetization, but a small percentage of those apps earn most of the revenue

Health and fitness apps earn big money, but only if you’re one of the lucky few that hit it big, a new report finds.

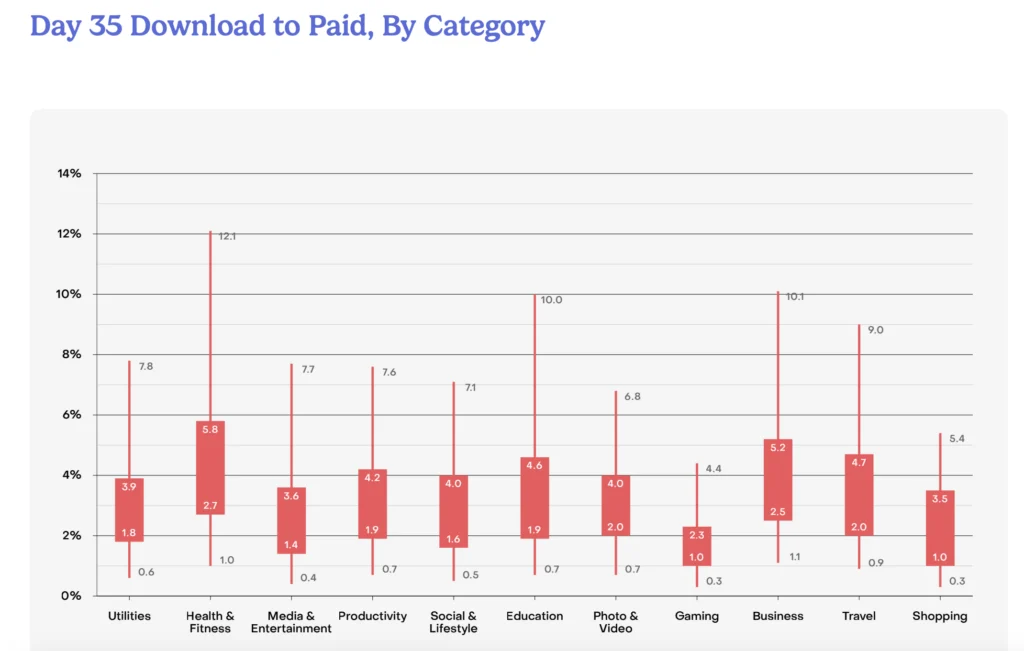

According to data from RevenueCat’s annual State of Subscription Apps report, health and fitness apps monetize at 2x the rate of most other categories. They also have the highest revenue per install of any app category, by far.

“While refunds are also high … the overall economics (of health and fitness apps) still beat almost every other app type,” a RevenueCat spokesperson tells Athletech News.

For example, health and fitness apps had a median average revenue per install (after 60 days) of $0.63, far higher than any other category. The next closest category was business apps, coming in at $0.29.

There’s a catch, though. The vast majority of health and fitness apps don’t hit it big.

Only 5% of health and fitness apps reach $10,000 in total revenue within their first two years, per RevenueCat.

The difference may lie in conversion rates. Across all health and fitness apps, the median trial-to-paid conversion rate (the amount of consumers who decide to pay for a subscription after a free trial) is 39.9%. However, the top 10% of health and fitness apps convert at a rate of 68.3%, crushing their competitors.

The takeaway for health and fitness app developers: focus on engagement.

“This suggests that habit-forming features, community engagement or premium content can drive stronger conversion outcomes,” the report hypothesizes.

Notably, conversion rates for health and fitness apps are around 2x higher on iOS devices compared to Android.

Longer Trial Periods Tend to Beat Shorter Ones

Across all categories, apps with longer trial periods tend to see better conversion rates. According to the report, apps with trials lasting 17-32 days had the highest median conversion rate, at 45.7%. Apps with a trial period of four days or less had just a 26.8% media conversion rate.

Shorter trials also tend to see the highest early cancellation rates. Apps with three and seven-day trials had the highest cancellation rates on Day 0 and Day 1. This suggests that “users may feel rushed to decide or may cancel preemptively to avoid being charged before exploring the app,” per the report.

For apps with longer trials, cancellations tend to be distributed more easily over time, the report found.

Thinking Beyond Subscriptions

Health and fitness app makers should also consider adding in-app purchases that go beyond subscriptions. According to the report, apps that adopt a hybrid monetization model – combining subscriptions with consumable in-app purchases – tend to make more money than apps that offer a subscription alone.

Health and fitness apps don’t offer consumable purchases as often as apps in categories like gaming, RevenueCat noted.

“By integrating consumables – such as one-time purchases for premium content, AI-generated insights or feature unlocks – subscription apps can better capture user demand and increase overall LTV (lifetime value),” the report states. “Users who may not commit to a full subscription might still be willing to make smaller purchases, providing an additional revenue layer.”

The Revenue Gap Is Growing

Overall, the report is good news for fitness brands with apps or those looking to get in on the action. However, entering the app game might not be for the faint of heart. Health and fitness isn’t the only app category where there’s a big gap between the haves and have-nots.

“The gap between winners and the rest is growing. … The top 5% of newly launched apps make over 400x as much money after 2 years, compared to the bottom 25%. … This gap has grown significantly since last year’s 200x,” the report states.

To view RevenueCat State’s of Subscription Apps 2025 report in full, see here.