Molson Coors goes beyond beer and backs the actor’s new business venture. Pitched as a healthier alternative to other energy drinks, the beverage newcomer, ZOA, is already seeing financial gains.

It looks like everyone wants a piece of what Dwayne “The Rock” Johnson is sippin. The actor and former wrestler’s energy drink, ZOA Energy, has been growing in popularity since it hit shelves in March, and backer Molson Coors couldn’t be more delighted.

Pete Marino, president of the brewer’s emerging growth division, calls the endeavor “tremendously successful thus far,” with ZOA spending the last four weeks as the number one new energy drink in the IRI data.

As health conscious consumers continue gravitating toward better-for-you drinks, Molson Coors has decided to expand its line of beverages to include functional water, ready-to-drink coffee, and energy drinks like ZOA, which they hold a minority stake in. Each subdivision has been growing, and the brewing company has already invested in ZenWTR, an alkaline water brand, and also partnered with La Colombe Coffee Roasters.

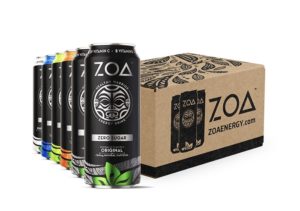

Branded as a healthier energy drink option, the majority of ZOA shares belong to Johnson and his cofounders: Dany Garcia (Johnson’s ex-wife), Dave Rienzi, and capital founder John Shulman. In a March press release, the beverage was described as a “re-imagined, first-of-its-kind energy drink.” Featuring superfood ingredients like camu-camu berries, each of the five flavors offered contains vitamins, and boast natural sources of caffeine like green-tea.

According to Allied Market Research, the energy drink market is slated to $86.01 billion by 2026, and ZOA Energy drinks are currently available at 26,000 retailers, surpassing 100,000 points of distribution.

“The energy drink category is dominated by , and nobody services the c-store channel better than the beer network and beer distributors,” says Marino.

It should be noted that not every distributor has been successful at entering the energy drink market. Coco-Cola’s Coke Energy was pulled from shelves after less than 2 years. While the pandemic may have been responsible for the decision, the recent uptick in Covid-19 cases hasn’t impacted ZOA.

“The demand signals and the velocities are actually increasing week-over-week now, so that’s a very encouraging sign for us,” Marino says.

Having Johnson as the face of ZOA Energy has helped the energy drink kick off to a strong start, but it’s not at the finish line yet. According to Statista, Red Bull continues to be the leader, while Monster Energy comes in at second place. However, the recent success of Bang Energy has Marino encouraged that they’ve made the right choice to back the actor’s company.

“The category is obviously dominated by very healthy competitors, but it also be disrupted, like Bang has most recently done, creating a billion dollar brand in the span of a few short years,” he says.