Unlocking Consumer Health Dollars: How Flex Is Redefining the Fitness Economy

Partnership

Sponsored By Flex

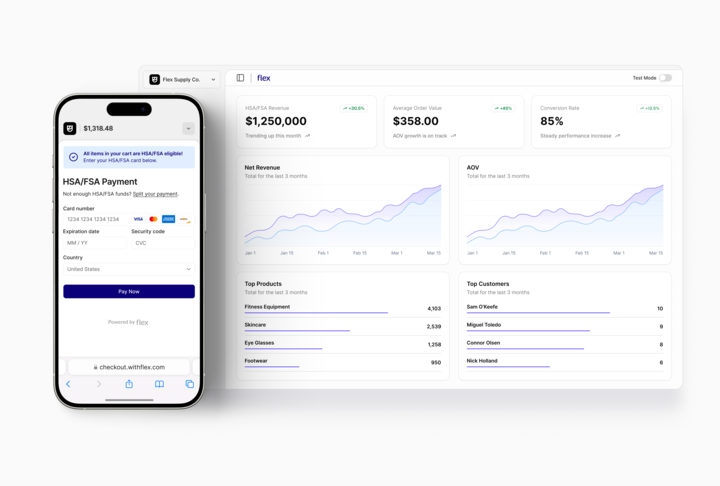

As consumer wellness surges and new legislation expands HSA access, Flex makes it simple for brands to accept pre-tax dollars — transforming unused benefits into real revenue.

Americans are sitting on billions of dollars earmarked for healthcare, but much of it is going unused. Nearly $150 billion currently resides in Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA). These funds are intended to make healthcare more accessible, yet a large share goes unspent every year because consumers often don’t know what qualifies as an eligible expense. Compounding the issue, many retailers don’t accept HSA or FSA cards at checkout, even when selling products that qualify.

The result: consumers leave an average of $400 unused in their FSA accounts each year, while brands lose out on revenue from purchases that could have been covered with pre-tax dollars.

At the same time, consumer health and wellness spending is surging. The $500 billion wellness market is growing at 5% annually, fueled by rising demand for fitness equipment, recovery tools, supplements and other lifestyle products. With HSA/FSA accounts expanding — and new legislation making millions more Americans eligible — the opportunity to connect these dots has never been clearer.

Enter Flex, an enterprise ready platform built to bridge the gap between consumers, their healthcare dollars and the brands they trust.

“The shift towards consumer-driven healthcare isn’t coming, it’s already here,” says Sam O’Keefe, Co-Founder and CEO of Flex. “For retailers, it’s an opportunity to remove friction from the buying process and connect health and health care.

A Turning Point for Brands

Flex enables retailers to accept HSA and FSA payments directly at checkout, eliminating the outdated reimbursement process. For fitness and wellness brands, this is more than a convenience — it’s a growth strategy.

O’Keefe points to Flex’s work with iFIT, the connected fitness giant behind NordicTrack, as an example of the impact. “By partnering with Flex, iFIT started accepting HSA and FSA funds at checkout, making it easier for customers to invest in smart fitness equipment with pre-tax dollars. That small change has had a big impact: it’s opened the door to new customers who might not have made the purchase otherwise, while also increasing accessibility for existing members. Flex now accounts for a significant percentage of iFIT’s total volume.”

That success highlights a broader truth: when consumers realize they can spend smarter with pre-tax funds, they buy more, buy faster and explore new categories.

“Brands see higher checkout conversion, larger cart sizes, fewer abandoned carts, and more first time buyers,” O’Keefe explains.”Consumers are excited to use their benefits dollars and are pushing merchants to adopt HSA/FSA payments.”Brands see higher checkout conversion, larger cart sizes, fewer abandoned carts, and more first time buyers,” O’Keefe explains.

As a result Flex has quickly expanded across wellness categories, including recovery, longevity, supplements and sleep. “Consumers are excited to use their benefits dollars and are pushing merchants to adopt HSA/FSA payments.”

In fact, Flex data shows checkout conversion rates jump by over 30%, average order value rises by more than 40%, and merchants gain roughly 15% more new customers when HSA/FSA payments are integrated.

Another reason Flex is gaining traction is its ease of integration. For retailers, adding a new payment method can be daunting — but Flex was designed to fit seamlessly into any business model.

“Our Shopify Payments app integrates directly into storefronts, our WooCommerce plug-in makes it simple to get up and running, and for brands with unique needs, our flexible API makes integration seamless,” O’Keefe says. “We meet you where you’re at and start driving results from day one.”

That flexibility has helped onboard a wide range of partners across many verticals.

The Legislative Landscape

“The recent tax bill expanded eligibility in important ways,” O’Keefe says. “Direct Primary Care fees are now HSA-eligible, up to $150 per month for individuals or $300 for families. Starting in 2026, Certain ACA Bronze and catastrophic plans also now qualify as High-Deductible Health Plans, meaning an estimated 7.3M people can open and fund HSAs.”

Although fitness memberships were not explicitly included, the groundwork is being laid. Consumers can already use HSA/FSA funds for equipment and even memberships with a letter of medical necessity. “This legislation helps legitimize wellness as part of healthcare spending,” O’Keefe notes. “It lays the foundation for future changes that could further integrate fitness into the healthcare system.”

While policy shifts open the door, the real transformation happens in how consumers interact with these benefits.

“When customers realize they can use pre-tax funds, it shifts the psychology,” O’Keefe says. “They’re more likely to add that recovery tool, upgrade to a higher-ticket item or try a new category. It’s not just about affordability; it’s about accessibility.”

That behavioral shift is powerful fuel for brands in a competitive marketplace. It positions health and wellness products not as luxury add-ons, but as legitimate healthcare investments.

Over the next three to five years, O’Keefe predicts HSA and FSA payments will move from being a “nice-to-have” option to a “must-have” option.

“We’re just scratching the surface,” she says. “As legislation continues to expand, we expect to see memberships, equipment, and digital services all wrapped into what’s considered health spending. That makes wellness more attainable for millions of people and creates a new growth engine for the industry. Long term, it reshapes the consumer wellness economy into a true extension of healthcare.”

For retailers and operators, the message is clear: ignoring HSA/FSA integration means leaving revenue on the table.