Global Wellness Market Hits Record $6.8T, Expected To Reach $9.8T by 2029

All 11 of the wellness sectors identified in a new Global Wellness Institute Report now exceed their pre-pandemic levels, with wellness real estate and mental health leading the way

The global wellness economy has officially bounced back from the pandemic, reaching new heights in its growth and valuation, hitting a new peak of $6.8 trillion.

A new report from the Global Wellness Institute (GWI) shows the steady growth of the worldwide wellness market, whose value has doubled since 2013 and grew 7.9% from 2023 to 2024. According to GWI, wellness has surpassed other major global industries, including tourism (valued at $5 trillion) and sports ($2.7 trillion).

All 11 of the wellness sectors identified — including personal care and beauty; nutrition and weight loss; physical activity; wellness tourism; wellness real estate; mental wellness, and more — now exceed their 2019 values, proving that the market has now moved beyond its pandemic struggles.

The fastest growing sectors are wellness real estate and mental wellness, which grew at rates of 19.5% and 12.4% annually, respectively, from 2019 to 2024.

“Now that the wellness economy has fully recovered from the pandemic, we can see how unstoppable it is as a consumer trend, and also how much the future growth has been accelerated by our pandemic experiences,” noted GWI senior research fellow Katherine Johnston.

What the Data Says About Wellness Trends

Each major regional wellness market has seen significant growth in the last five years, including North America at 7.9%, Middle East-North Africa at 7.2% and Europe at 6.3%.

Those insights map onto spending trends as well. North America’s per capita spending on wellness is dramatically higher than its counterparts at $6,029, with Europe following at $1,876, Latin America-Caribbean at $607, Asia at $471 and the Middle East-North Africa at $339.

Going deeper into the data, the American market for mental wellness — the second-fastest growing sector — continues to dominate other countries, with a $125 billion valuation, as China comes in at a distant second of $16 billion.

Within the mental wellness market, GWI found that specific segments drove annual growth, including cannabis products (26%), meditation and mindfulness (18.9%) and sleep (12.6%).

While wellness tourism was understandably hit hard by the pandemic, it seems that people longing for connection, travel and to improve their mental and physical health in one setting have helped catapult the sector upward.

Between 2023 and 2024, wellness tourism grew 13.8%, while spas grew 14.6% and thermal/mineral springs 11.1%.

“There’s been a sea change in consumer mindsets, with prevention, mental health, social connection, the impacts of our living environments and nature becoming dramatically more important all over the world,” Johnston said. “These shifts are fueling growth across all wellness sectors, from wellness real estate and mental wellness to hot springs and social bathing to more sophisticated preventative medical-wellness solutions.”

GWI not only foresees the market growing even more, but at a faster rate.

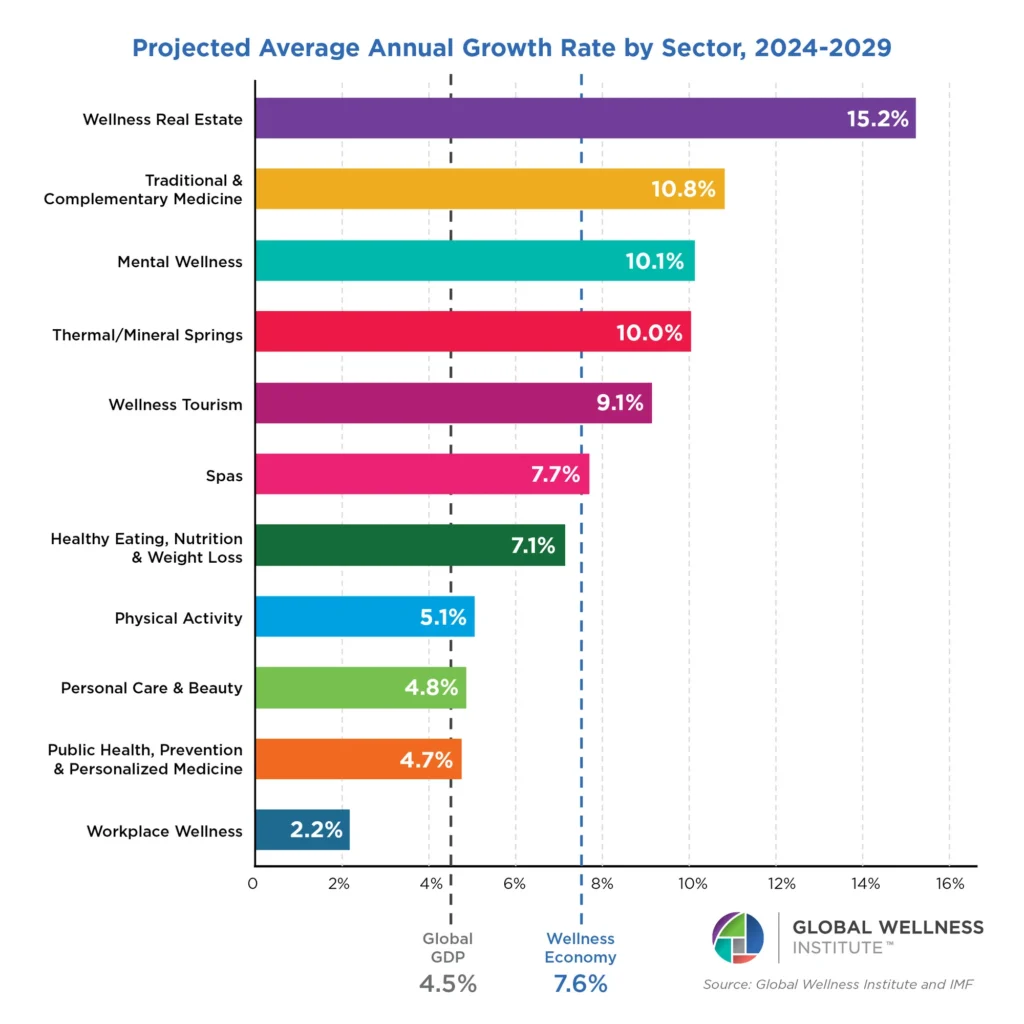

Trends fueling the wellness industry will only continue advancing — an aging population, chronic disease, mental health struggles and a pronounced focus on preventive care and longevity. With that in mind, GWI estimates the wellness industry will grow at a rate of 7.6% annually through 2029, hitting $9.8 trillion.

The number-one driver of that growth, GWI claims, is wellness real estate, whose growth surpassed all other sectors. In second, however, is traditional/complementary medicine, GWI predicts, because the sector includes the trending longevity and biohacking care — such as infrared light therapy, cryotherapy and hyperbaric chambers.

The report also notes that the $147 billion personalized medicine market has a projected 9.3% annual future growth rate through 2029, playing into the emphasis on longevity as more and more consumers opt for individualized diagnostic services.